SETTLEMENT AGREEMENT

Certain portions of this exhibit (indicated by “[***]”) have been omitted pursuant to Item

601(b)(10) of Regulation S-K. Such excluded information is not material and would likely cause

competitive harm to the registrant if publicly disclosed.

Exhibit 10.1

SETTLEMENT AGREEMENT

This Settlement Agreement (this “Agreement”) is made as of June 6, 2020 (the “Execution Date”), by and among (a) the Debtors, (b) Catarina Midstream, (c) Xxxxxxx G&P, (d) Seco Pipeline, (e) SNMP, (f) Xxxxxxx Midstream Partners GP, LLC, (g) SP Holdings, LLC and (h) Targa. Each of the Debtors, Catarina Midstream, Xxxxxxx G&P, Seco Pipeline, SNMP, and Targa may be referred to in this Agreement individually as a “Party” and collectively as the “Parties.” Capitalized terms not otherwise defined herein shall have the meanings ascribed to such terms in section 1.1 of this Agreement.

RECITALS

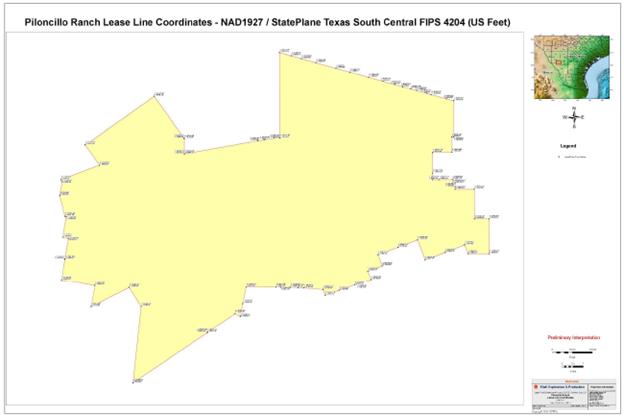

WHEREAS, the Debtors, primarily SN Catarina, have rights to explore and produce oil and gas on certain Eagle Ford Shale properties, which include approximately 106,000 net acres in Dimmit, La Salle, and Xxxx Counties, Texas and are referred to as the “Catarina” properties;

WHEREAS, the Debtors are in need of, among other things, “midstream” and “marketing” services, including gathering, transportation and processing services, to exploit the foregoing exploration and production rights economically;

WHEREAS, Catarina Midstream is a party to the Catarina Gathering Agreement pursuant to which it currently provides certain wellhead gathering, transportation, processing, and other services to SN Catarina with respect to the Debtors’ Catarina oil and gas assets;

WHEREAS, by letters dated December 21, 2018 and March 18, 2019, Catarina Midstream raised gathering and processing fees on volumes produced from xxxxx on the Eastern Catarina Acreage;

WHEREAS, the Debtors allege that such changes in fees were improper and, as a result, constituted breaches of the Catarina Gathering Agreement, and Catarina Midstream disputes all such allegations;

WHEREAS, the Debtors presently have no economically viable alternative for the gathering of oil and gas from a substantial portion of their xxxxx on the Catarina Acreage without access to the gathering system owned or operated by Catarina Midstream;

WHEREAS, Xxxxxxx G&P is a party to certain gas gathering, processing, and natural gas liquids purchase agreements with certain of the Debtors, including the Xxxxxxx Agreements, with respect to the Debtors’ Catarina gas assets;

WHEREAS, the Debtors filed for relief under chapter 11 of the United States Bankruptcy Code, 11 U.S.C. §§ 101-1532, on August 11, 2019, and the Bankruptcy Court confirmed the Plan on April 30, 2020;

WHEREAS, the Plan contemplates the rejection, assumption, and resolution of objections to assumption or rejection of agreements following confirmation of the Plan;

WHEREAS, certain disputes exist between and among the Parties relating to, inter alia, the treatment under the Plan of their respective claims, causes of action, defenses, and agreements, including but not limited to the assumption or rejection of certain agreements;

WHEREAS, resolution of such disputes on the terms set forth in this Agreement is critical to the successful reorganization of the Debtors’ business and operations;

WHEREAS, the Debtors have concluded, after considering all the costs, risks, and potential outcomes of continued litigation among the Parties and/or other parties, that the benefits provided in this Agreement are in the best interests of the Debtors and their estates; and

WHEREAS, the Parties have agreed to a global resolution among them in order to resolve the various claims, defenses, causes of action, and other disputes among them on the terms and subject to the conditions set forth in this Agreement.

NOW, THEREFORE, in consideration of the representations, warranties, covenants, releases, and other agreements contained in this Agreement, and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, on the terms and subject to the conditions of this Agreement, the Parties hereby agree as follows:

ARTICLE 1

DEFINITIONS AND RULES OF INTERPRETATION

1.1 Definitions. Except as otherwise expressly set forth herein, the following terms have the following meanings:

“Affirmative Covenant Agreements” means, collectively, the Midstream Agency Agreement, the Brasada Processing Agreement, the EFG Processing Agreement, the ETC Processing Agreement, the Enterprise Purchase Agreement, the Enterprise Transportation Agreement, and the Other Xxxxxxx G&P Rejection Agreements.

“Agency Agreements” means, together, the Marketing Agency Agreement and the Midstream Agency Agreement.

“Amendment Agreements” means, collectively, the Xxxxxxx Agreement Amendment, the LLC Agreement Amendment, the NGL Sales Agreement Amendment, the New Seco Pipeline Agreements, and the Catarina Gathering Amendment.

“Anadarko Parties” means any of Anadarko Petroleum Corporation, Anadarko Energy Services Company, Anadarko E&P Onshore, LLC, Anadarko E&P Company LP, Xxxx-XxXxx Oil & Gas Onshore LP, Xxxx-XxXxx Oil & Gas Onshore, LLC, Springfield Pipeline, LLC, WGR Operating, LP, Western Gas Operating, LLC, Western Gas Partners, LP, Western Midstream Partners, LP, or any of their respective affiliates.

“Approval Date” means the date on which the Bankruptcy Court enters the Approval Order.

2

“Approval Order” means an order of the Bankruptcy Court reasonably acceptable to the Parties, entered pursuant to Rule 9019 of the Federal Rules of Bankruptcy Procedure, approving this Agreement and authorizing the Parties to perform hereunder, which order has not been reversed, vacated or stayed.

“Assumption Agreements” means, collectively, the Xxxxxxx Agreements and the Catarina Gathering Agreement, the Mitsui Letter Agreement and the various Ratification Agreements by and among Xxxxxxx G&P, SN Maverick and each of the Other Comanche Working Interest Holders pursuant to which the Other Comanche Working Interest Holders ratified the Comanche FGGPA.

“Bankruptcy Cases” means the chapter 11 cases of the Debtors pending before the Bankruptcy Court, styled In re Xxxxxxx Energy Corporation, et al., Case No. 19-34508 (MI) (Bankr. S.D. Tex.) (Jointly Administered).

“Bankruptcy Court” means the United States Bankruptcy Court for the Southern District of Texas.

“Bankruptcy Rules” means the Federal Rules of Bankruptcy Procedure.

“BP Oil Purchase Agreement” means that certain Agreement, dated as of December 13, 2013, by and between BP Products North America Inc., as Buyer, and Anadarko E&P Onshore LLC, as Seller, as amended or modified from time to time, including by that certain First Amendment to Agreement, dated as of February 2015.

“Brasada Processing Agreement” means that certain Gas Processing Agreement, dated as of February 27, 2012, by and between WGR Operating, LP, as Processor, and Anadarko E&P Company LP, as Supplier, as amended or modified from time to time, including by that certain Gas Processing Agreement Amendment No. 1, dated as of January 3, 2013, that certain Gas Processing Agreement Amendment No. 2, dated as of March 11, 2014, that certain Gas Processing Agreement Amendment No. 3, dated as of September 1, 2016, and that certain Gas Processing Agreement Amendment No. 4, dated as of September 1, 2016.

“Xxxxxxx Agreement Amendment” means that certain Second Amendment Agreement, dated as of the Approval Date and effective as of the Closing Date, by and among Xxxxxxx G&P, SN and SN Catarina, in the form attached hereto as Exhibit C.

“Xxxxxxx Agreements” means, together, the Xxxxxxx Gathering Agreement and the Xxxxxxx Processing Agreement.

“Xxxxxxx G&P” means Xxxxxxx G&P LLC, a joint venture owned 50% by SNMP and 50% by Targa.

“Xxxxxxx Gathering Agreement” means that certain Firm Gas Gathering Agreement, dated as of October 2, 2015, by and among SN, SN Catarina, and Targa (as predecessor in interest to Xxxxxxx G&P), as amended or modified from time to time and as in effect on the Execution Date, including by that certain Omnibus Amendment, dated as of June 23, 2016, that certain First Amendment to

3

Firm Gas Gathering Agreement, dated as of May 1, 2017, and that certain Amendment Agreement, dated as of April 1, 2018.

“Xxxxxxx Processing Agreement” means that certain Firm Gas Processing Agreement, dated as of October 2, 2015, by and among SN, SN Catarina, and Targa (as predecessor in interest to Xxxxxxx G&P), as amended or modified from time to time and as in effect on the Execution Date, including by that certain Omnibus Amendment, dated as of June 23, 2016, that certain First Amendment to Firm Gas Gathering Agreement, dated as of May 1, 2017, and that certain Amendment Agreement, dated as of April 1, 2018.

“Catarina Acreage” means the “Dedicated Acreage,” as such term is defined in the Xxxxxxx Agreements.

“Catarina Gathering Agreement” means that certain Firm Gathering and Processing Agreement, dated as of October 14, 2015, by and between SN Catarina, as Producer, and Catarina Midstream, as Gatherer, as amended by that certain Amendment No. 1 to Firm Gathering and Processing Agreement, executed on June 30, 2017 but effective as of April 1, 2017, and as in effect on the Execution Date.

“Catarina Gathering Amendment” means that certain Amended and Restated Firm Gathering and Processing Agreement, dated as of the Approval Date and effective as of the Closing Date, by and between SN Catarina, as Producer, and Catarina Midstream, as Gatherer, in the form attached hereto as Exhibit F.

“Catarina Midstream” means Catarina Midstream LLC, a wholly-owned direct subsidiary of SNMP.

“Closing” means the consummation of the Midstream Transaction as contemplated in section 2.5, following satisfaction of the Closing Conditions Precedent or waiver thereof in accordance with section 4.6.

“Closing Conditions Precedent” means, collectively, the conditions precedent set forth in sections 4.2 through 4.5.

“Closing Date” means the date the Closing occurs in accordance with this Agreement.

“Closing Notice” means a notice of the occurrence of Closing in the form attached hereto as Exhibit G.

“Closing Outside Date” means 5:00 pm Houston, TX time on October 1, 2020.

“Comanche Acreage” means the “Dedicated Acreage,” as such term is defined in the Comanche FGGPA, provided that the Comanche Acreage shall not include acreage (or associated xxxxx) serviced as of the Execution Date under the Xxxxxx Gathering Agreement, unless and until such amounts become dedicated in accordance with the Comanche FGGPA and are not subject to a temporary release in accordance with section 2.1 of the Comanche FGGPA.

4

“Comanche FGGPA” means that certain Firm Gas Gathering, Processing and Purchase Agreement, dated as of April 1, 2018, by and between SN Maverick and Xxxxxxx G&P, as amended or modified from time to time and as in effect on the Execution Date, including by that certain Amendment to Firm Gas Gathering, Processing and Purchase Agreement dated as of April 1, 2018.

“Confirmation Order” means the Order Approving Disclosure Statement and Confirming Second Amended Joint Chapter 11 Plan of Reorganization of Xxxxxxx Energy Corporation and its Debtor Affiliates [DKT. #1212], entered by the Bankruptcy Court in the Bankruptcy Cases on April 30, 2020, as amended or modified.

“Continuing Requirement” means the procedure set forth in Exhibit G of the Xxxxxxx Agreement Amendment.

“Debtors” means, collectively, prior to the Effective Date, SN and each of its direct and indirect subsidiaries that are debtors and debtors-in-possession in the Bankruptcy Cases, including SN Maverick and SN Catarina, and, after the Effective Date, such entities as reorganized pursuant to the Plan.

“Double Eagle Transportation Agreement” means that certain Throughput and Deficiency Agreement, dated as of December 13, 2013, by and among Anadarko E&P Onshore LLC, Double Eagle Pipeline LLC, and Xxxxxx Xxxxxx Crude & Condensate LLC, as amended or modified from time to time.

“Eastern Catarina Acreage” means the section of the Catarina Acreage which does not form part of the “Dedicated Acreage,” as such term is defined in the Catarina Gathering Agreement.

“Effective Date” has the meaning ascribed to such term in the Plan.

“EFG Processing Agreement” means that certain Gas Services Agreement between SWEPI LP (predecessor in interest to SN Catarina) and Eagle Ford Gathering LLC, dated as of November 1, 2011, as amended from time to time, including by that certain First Amendment to Gas Services Agreement, dated as of August 8, 2014, that certain Second Amendment to Gas Services Agreement, dated as of September 29, 2015, and that certain Third Amendment to Gas Services Agreement, dated as of August 1, 2016.

“EFM Agreements” means, together, the Intrastate EFM Agreement and the Interstate EFM Agreement.

“EFM Assignment Agreement” means that certain Assignment and Consent to Assignment Agreement, dated as of June 28, 2017, by and among Anadarko Energy Services Company, as Assignor, SN Maverick, as Assignee, and Eagle Ford Midstream, LP, as Consenting Party.

“Enterprise Purchase Agreement” means that certain Purchase Agreement, dated as of March 1, 2012, by and between Anadarko Energy Services Company and Enterprise Products Operating LLC, as amended or modified from time to time.

5

“Enterprise Transportation Agreement” means that certain Transportation Services Agreement, dated as of March 1, 2012, by and between Enterprise Products Operating LLC and Anadarko Energy Services Company, as amended or modified from time to time.

“ETC Processing Agreement” means that certain Gathering and Processing Agreement, dated as of April 1, 2011, by and between Anadarko E&P Company LP and ETC Texas Pipeline, Ltd., as amended or modified from time to time.

“Final Order” means an order or judgment of a court of competent jurisdiction, including the Bankruptcy Court, that has been entered on the docket maintained by the clerk of such court and has not been reversed, vacated, or stayed and as to which (a) the time to appeal, petition for certiorari, or move for a new trial, reconsideration, or rehearing has expired and as to which no appeal, petition for certiorari, remand proceeding, or other proceedings for a new trial, reconsideration, or rehearing shall then be pending, or (b) if an appeal, writ of certiorari, new trial, reconsideration, or rehearing thereof has been sought, (i) such order or judgment shall have been affirmed or reversed in part or in full, with no further proceedings on remand, by the highest court to which such order was appealed, certiorari shall have been denied, or a new trial, reconsideration, or rehearing shall have been denied or resulted in no modification of such order, and (ii) the time to take any further appeal, petition for certiorari, or move for a new trial, reconsideration, or rehearing shall have expired; provided, however, that the possibility that a motion pursuant to rule 60 of the Federal Rules of Civil Procedure, or any analogous rule under the Bankruptcy Rules, may be filed relating to such order shall not prevent such order from being a Final Order.

“Xxxxxx Gathering Agreement” means that certain Firm Transportation Agreement, effective October 1, 2009, by and between Texas Pipeline LLC and Anadarko E&P Company LP, as amended or modified from time to time, including by that certain First Amendment to Firm Transportation Agreement, dated as of September 1, 2012, that certain Second Amendment to Firm Transportation Agreement, dated as of December 4, 2012, and that certain Third Amendment to Firm Transportation Agreement, dated as of October 1, 2016.

“Interstate EFM Agreement” means that certain Firm NGPA Section 311 Gas Transportation Agreement, dated as of January 17, 2012, by and between Anadarko Energy Services Company and Eagle Ford Midstream, LP, as amended or modified from time to time, including by that certain First Amendment to Firm NGPA Section 311 Transportation Agreement, dated as of June 27, 2016, and as assigned to SN Maverick in accordance with the EFM Assignment Agreement.

“Intrastate EFM Agreement” means that certain Firm Intrastate Gas Transportation Agreement, dated as of January 17, 2012, by and between Anadarko Energy Services Company and Eagle Ford Midstream, LP, as amended or modified from time to time, including by that certain First Amendment to Firm Intrastate Gas Transportation Agreement, dated as of June 27, 2016, and as assigned to SN Maverick in accordance with the EFM Assignment Agreement.

“LC Deposit Funds” means the funds, in the amount of $17,078,144.00, held on deposit by Xxxxxxx G&P from the proceeds of the draw of a letter of credit posted by SN to Xxxxxxx G&P in accordance with the Xxxxxxx Agreements.

6

“LLC Agreement” means that certain Second Amended and Restated Limited Liability Company Agreement of Xxxxxxx G&P, dated as of April 1, 2018, by and between SNMP and Targa, as amended or modified from time to time.

“LLC Agreement Amendment” means the amendment to the LLC Agreement, to be dated as of the Closing Date, in form and substance agreed upon by SNMP and Targa prior to the Execution Date.

“Marketing Agency Agreement” means that certain Retained Marketing Contracts Services Agreement, by and between SN Maverick and SN Catarina, collectively, as Provider, and Anadarko E&P Onshore LLC, Xxxx-XxXxx Oil & Gas Onshore LP, and Anadarko Energy Services Company, collectively, as Recipient, as amended or modified from time to time and in effect on the Execution Date, including by that certain First Amendment to the Retained Marketing Contracts Services Agreement, dated as of June 28, 2017, and that certain Second Amendment to the Retained Marketing Contracts Services Agreement, dated as of September 15, 2017.

“Midstream Agency Agreement” means that certain Retained Midstream Contracts Services Agreement, by and between SN Maverick, as Provider, and Anadarko E&P Onshore LLC and Xxxx-XxXxx Oil & Gas Onshore LP, together, as Recipient, as amended or modified from time to time and in effect on the Execution Date.

“Midstream Transaction” means the transactions described in section 2.5, which shall occur and/or become effective following the date upon which the Closing Conditions Precedent have been met and the Closing has occurred.

“Mitsui Letter Agreement” means that certain Letter Agreement re: Retained Take-in-Kind Rights of Mitsui E&P Texas LP in Volumes Committed to the Raptor Gas Processing Facility in La Salle County, Texas, executed as of May 2018, by and among Mitsui E&P Texas LP, SN Maverick, and Xxxxxxx G&P.

“New Catarina-Seco Agreement” means that certain Firm Transportation Service Agreement, dated as of the Approval Date and effective as of the Closing Date, by and among Seco Pipeline and SN Catarina, in the form attached hereto as Exhibit D.

“New Comanche-Seco Agreement” means that certain Firm Transportation Service Agreement, dated as of the Approval Date and effective as of the Closing Date, by and among Seco Pipeline and SN Maverick, in the form attached hereto as Exhibit E.

“New Seco Pipeline Agreements” means, together, the New Catarina-Seco Agreement and the New Comanche-Seco Agreement.

“NGL Sale Agreement” means that certain NGL Sale Agreement (Raptor Plant and Silver Oak II Plant), dated as of April 1, 2018, by and between Xxxxxxx G&P and Targa Liquids, as amended or modified from time to time.

7

“NGL Sale Agreement Amendment” means an amendment to the NGL Sale Agreement, dated as of the Approval Date and effective as of the Closing Date, in form and substance agreed upon by SNMP, Targa, Xxxxxxx G&P and Targa Liquids prior to the Execution Date.

“Non-Anadarko Party” means any party to (a) either of the EFM Agreements or (b) any of the Underlying Agreements, in the case of either (a) or (b) other than an Anadarko Party.

“Other Xxxxxxx G&P Rejection Agreements” means, collectively, the agreements set forth on Exhibit B attached hereto.

“Other Comanche Working Interest Holders” means, collectively, Gavilan Resources, LLC, Eagle Ford TX LP, Mitsui E&P Texas LP, SN EF UnSub, LP, and Venado EF L.P., and each of their respective successors and assigns.

“Plan” means the Second Amended Joint Chapter 11 Plan of Reorganization of Xxxxxxx Energy Corporation and its Debtor Affiliates, dated as of April 30, 2020 [DKT. #1205], as amended or modified from time to time.

“Raptor Plant” means the Raptor gas processing plant located in La Salle County, Texas, and operated by Xxxxxxx G&P.

“Rejection Agreements” means the Agency Agreements, the EFM Agreements, the EFG Processing Agreement, and the Other Xxxxxxx G&P Rejection Agreements, in each case to the extent such Rejection Agreements may be rejected pursuant to the Plan and 11 U.S.C. § 365.

“Rejection Litigation” means and any claims, objections, causes of action, and other litigation brought by or on behalf of any Anadarko Party or Non-Anadarko Party, in each case to the extent asserting that any of the Debtors remain bound, or will remain bound, by any material covenants or other material obligations set forth in the Underlying Agreements following the rejection of the Agency Agreement governing SN Maverick’s and/or SN Catarina’s agency with respect to the applicable Underlying Agreement.

“Second Installment Conditions” means, collectively, (a) the satisfaction or waiver of the conditions precedent set forth in sections 4.2.2 and 4.2.3 and (b) entry of one or more orders of the Bankruptcy Court approving the Debtors’ rejection of (or otherwise finding that such agreements do not continue to bind any of the Debtors in any material respect): (i) the EFG Processing Agreement and (ii) to the extent applicable, each of the Other Xxxxxxx G&P Rejection Agreements; provided that the effective waiver by a Party of a condition precedent set forth in sections 4.2.2, 4.2.3, 4.4.2(a), or 4.4.2(b) shall be deemed a waiver of the requirements set forth in the immediately preceding clauses (b)(i) or (b)(ii) by the same Party with respect to the same condition precedent, respectively.

“Second Installment Orders” means, collectively, the order or orders of the Bankruptcy Court, if any, satisfying the conditions set forth in clauses (a) and (b) of the definition of Second Installment Conditions.

8

“Seco Administrative Expense Claim” means the administrative expense claim asserted against the Debtors by Seco Pipeline in an amount of not less than $1,944,800 for unpaid amounts allegedly due under that certain Firm Transportation Services Agreement, dated as of September 1, 2017, by and between Seco Pipeline and SN Catarina, which agreement was previously terminated by SN Catarina.

“Seco Pipeline” means Seco Pipeline, LLC, a wholly-owned direct subsidiary of SNMP.

“SN” means Xxxxxxx Energy Corporation.

“SN Catarina” means SN Catarina, LLC.

“SN Maverick” means SN EF Maverick, LLC.

“SNMP” means Xxxxxxx Midstream Partners, LP.

“Targa” means TPL SouthTex Processing Company LP.

“Targa Liquids” means Targa Liquids Marketing and Trade LLC, an affiliate of Targa.

“Term Sheet” means the Term Sheet attached hereto as Exhibit A.

“Underlying Agreements” means, collectively, the Brasada Processing Agreement, the ETC Processing Agreement, the Enterprise Transportation Agreement, the Enterprise Purchase Agreement, the BP Oil Purchase Agreement, and the Double Eagle Transportation Agreement.

1.2 Rules of Interpretation. All references in this Agreement to articles, sections, subsections, Exhibits (as defined below), and other subdivisions refer to corresponding articles, sections, subsections, Exhibits, and other subdivisions of this Agreement unless expressly provided otherwise. Titles appearing at the beginning of any articles, sections, subsections, Exhibits, and subdivisions are for convenience only and will not constitute part of such articles, sections, subsections, Exhibits, and subdivisions and will be disregarded in construing the language contained in such articles, sections, subsections, Exhibits, and subdivisions. The words “this Agreement,” “herein,” “hereof,” “hereby,” “hereunder,” and words of similar import refer to this Agreement as a whole and not to any particular subdivision unless expressly so limited. Words in the singular form will be construed to include the plural and vice versa, unless the context otherwise requires. References to a written agreement refer to such agreement as it may be amended, modified, or supplemented from time to time. Pronouns in masculine, feminine, and neuter genders will be construed to include any other gender. This Agreement will inure to the benefit of and be binding upon the Parties and their respective successors and permitted assigns. Examples will not be construed to limit, expressly or by implication, the matter they illustrate. The word “includes” and its derivatives means “includes, but is not limited to” and corresponding derivative expressions. Where a date or time period is specified, it will be deemed inclusive of the last day in such period or the date specified, as the case may be. No consideration will be given to the fact or presumption that one Party had a greater or lesser hand in drafting this Agreement. The Recitals are incorporated into and form part of this Agreement and shall be deemed true and correct representations of the Parties’ respective positions with respect to the statements therein.

9

1.3 Exhibits. The following exhibits (collectively “Exhibits,” and each an “Exhibit”) are attached to, form part of, and are incorporated herein by reference as though contained in the body of this Agreement:

Exhibit A Term Sheet

Exhibit B Other Xxxxxxx G&P Rejection Agreements

Exhibit C Xxxxxxx Agreement Amendment

Exhibit D New Catarina-Seco Agreement

Exhibit E New Comanche-Seco Agreement

Exhibit F Catarina Gathering Amendment

Exhibit G Closing Notice

Whenever any term or condition, whether express or implied, of any Exhibit conflicts with or is at variance with any term or condition of the body of this Agreement, the terms and conditions of the body of this Agreement will prevail to the extent of such conflict or variance.

ARTICLE 2

AGREEMENTS OF THE PARTIES

2.1 LC Deposit Funds.

2.1.1 Delivery of LC Deposit Funds to SN (up to $14 million). Upon the occurrence of both the Approval Date and the execution of the Amendment Agreements and other agreements as required pursuant to section 2.5.1, Xxxxxxx G&P will return or otherwise cause to be delivered to SN from the LC Deposit Funds $8 million in cash, by wire transfer of immediately available funds to a bank account designated in writing by SN. On the date that is the sixtieth (60th) day following the satisfaction of the Second Installment Conditions (or, if such date is not a business day, the next business day), Xxxxxxx G&P will return or otherwise cause to be delivered to SN from the LC Deposit Funds an additional $6 million in cash (the “Second Installment”), by wire transfer of immediately available funds to a bank account designated in writing by SN; provided, however, that, if, as of the date that the Second Installment is otherwise required to be returned or delivered to SN pursuant to this section 2.1.1, any of the Second Installment Orders has been stayed by an order of a court of competent jurisdiction, the Second Installment will instead be delivered to SN within three (3) days following the lifting or termination of such stay. The date on which the Second Installment is delivered to SN in accordance with the prior sentence shall be referred to as the “Second Installment Date.” Delivery of the LC Deposit Funds pursuant to this paragraph will be deemed consistent with the terms of the Xxxxxxx Agreements, and Xxxxxxx G&P agrees that, except as expressly permitted by the terms of the Xxxxxxx Agreement Amendment, it will not request the issuance of a new or replacement letter of credit or other form of credit assurance from the Debtors under the Xxxxxxx Agreements, unless this Agreement has been terminated, the Debtors are in material breach hereof, and/or the Xxxxxxx Agreement Amendment has not been executed and delivered as contemplated herein or, following the Closing Date, is no longer in full force and effect as against the Debtors.

2.1.2 Remaining LC Deposit Funds. On the Second Installment Date, all remaining LC Deposit Funds not returned to SN in accordance with section 2.1.1 (the “Remaining LC Amounts”) shall be retained by and become the property of Xxxxxxx G&P; provided, however,

10

if, after the Second Installment Date, any of the other LC Deposit Funds are returned to Xxxxxxx G&P pursuant to this Agreement, then the Remaining LC Amounts shall not be retained by and become the property of Xxxxxxx G&P and shall be held solely as credit support in accordance with the Xxxxxxx Agreements, whether before or after it is amended by the Xxxxxxx Agreement Amendment; provided further that if the same LC Deposit Funds that were returned to Xxxxxxx G&P are then subsequently returned by Xxxxxxx G&P to the Debtors under the terms of the Xxxxxxx Agreements or Xxxxxxx Agreement Amendment, the Remaining LC Amounts shall again be fully and finally retained by and become the property of Xxxxxxx G&P. Retention of the Remaining LC Amounts by Xxxxxxx G&P to the extent permitted by this section 2.1.2 is consideration for Xxxxxxx G&P entering into this Agreement and is not an offset, credit or reduction against the Debtors’ other obligations.

2.2 Post-Approval Date Agreements.

2.2.1 Affirmative Covenants.

(a) The Debtors hereby covenant and agree:

(i) To elect, and do hereby elect, to place on the Schedule of Rejected Executory Contracts and Unexpired Leases (as defined in the Plan) the Affirmative Covenant Agreements and agree that they will not change such election;

(ii) Not to request any further extension of the Contract Objection Deadline (as defined in the Confirmation Order), solely with respect to any of the Affirmative Covenant Agreements; and

(iii) To diligently (a) pursue rejection, to the extent permitted under 11 U.S.C. §365, of the Affirmative Covenant Agreements, including (x) fully prosecuting any appeals related to such rejection, (y) opposing any requested stays of the orders approving rejection of the Affirmative Covenant Agreements, and (z) taking appropriate legal actions related to the foregoing.

(b) If the Debtors fail in any material respect to continue to diligently pursue rejection and related appeals in accordance with section 2.2.1(a) at any time prior to final resolution of all such matters, (i) SN shall, promptly upon demand by Xxxxxxx G&P, return to Xxxxxxx G&P all amounts of the LC Deposit Funds actually delivered to SN pursuant to this Agreement, which amounts shall thereafter be held in accordance with the existing Xxxxxxx Agreements, as applicable, and (ii) for purposes of clarification, if the Continuing Requirement has become effective in accordance with the terms of this Agreement and the Xxxxxxx Agreement Amendment, in addition to the remedies in the immediately preceding clause (i), the Continuing Requirement procedure shall continue to apply. The remedies set forth in this section 2.2.1 shall be the sole remedies for the Debtors’ failure to continue to diligently pursue rejection and related appeals as set forth in section 2.2.1(a)(iii). Upon the entry of one or more Final Orders approving the rejection of all of the Affirmative Covenant Agreements or otherwise finding that the Debtors do not remain bound by any material obligations set forth in the Affirmative Covenant Agreements, the Debtors shall be deemed to have complied with the covenants in this section 2.2.1.

11

(c) From and after the Approval Date, each of the other Parties agrees and covenants to: (i) cooperate with and undertake commercially reasonable efforts to assist and support the Debtors in their pursuit and prosecution of the rejection of the Rejection Agreements and resolution of any claims, objections, causes of action, and other litigation related thereto; (ii) cooperate with the Debtors and negotiate in good faith in connection with, and to exercise commercially reasonable efforts with respect to, the pursuit, approval of, and implementation of the Midstream Transaction and other covenants and agreements set forth herein; and (iii) take such action as may be reasonably necessary or reasonably requested by the Debtors to carry out the purposes and intent of this Agreement, and shall refrain from taking any action that would frustrate the purposes and intent of this Agreement.

(d) Further, from and after the Approval Date, the Debtors will not remove any executory contracts or unexpired leases from the Schedule of Assumed Executory Contracts and Unexpired Leases (as defined in the Plan), the removal of which would reasonably be expected to adversely affect the Debtors’ ability to perform any material obligation under either this Agreement or the agreements to be executed by the Parties pursuant to section 2.5.

2.3 Delivery of Gas at Raptor Tailgate. From and after the Approval Date and through the Closing, the Debtors will use commercially reasonable efforts to obtain any and all consents and agreements necessary to permit the Debtors to deliver their owned and controlled gas and all Other Comanche Working Interest Holders’ gas, in each case, flowing through the tailgate of the Raptor Plant, for transportation and redelivery on a month-to-month basis by Seco Pipeline, and the Debtors shall deliver all such gas that is processed at the Brasada natural gas processing plant in La Salle County, Texas or to be processed at the Raptor Plant at the tailgate of the Raptor Plant (or by way of the Raptor Plant), but specifically excluding gas that is processed at any of the Xxxxxxx G&P processing plants in Bee County, Texas, subject only to the satisfaction of the applicable current monthly minimum volume commitment obligation under the current sole existing minimum volume commitment contract for residue gas should it continue to be in effect; provided that any volumes delivered by or on behalf of the Debtors or the Other Comanche Working Interest Holders pursuant to this Section 2.3 prior to the Closing will be transported and redelivered by Seco Pipeline on economic and other terms no less favorable to the Debtors and the Other Comanche Working Interest Holders than the terms contained in the New Seco Pipeline Agreements. Any volumes in excess of the current minimum volume commitment contract, should it continue to be in effect, would be subject to Debtors’ obligations under this Section 2.3. The Debtors shall not enter into any new minimum volume commitments, dedications, or other contracts that would hinder its ability to fulfill Debtors’ obligations under this Section 2.3.

2.4 Contribution of Administrative Expense Claim. Seco Pipeline agrees that, as of the Approval Date, any and all recoveries to which it would otherwise be entitled on account of the Seco Administrative Expense Claim will be contributed to the Debtors and used to pay, on the Effective Date, other administrative expense claims of the Debtors’ estates. For purposes of clarification, no distribution will be made under the Plan to any holder of the Seco Administrative Expense Claim.

12

2.5 Approval Date and Closing Date Agreements.

2.5.1 Execution of Amendments and Other Agreements. On the Approval Date, each of the Parties agrees to take the following actions, as applicable:

(a) the Debtors will execute and deliver (i) the Xxxxxxx Agreement Amendment, (ii) the Catarina Gathering Amendment, and (iii) the New Seco Pipeline Agreements;

(b) Catarina Midstream will execute and deliver the Catarina Gathering Amendment;

(c) Xxxxxxx G&P will execute and deliver the Xxxxxxx Agreement Amendment and the NGL Sales Agreement Amendment;

(d) Seco Pipeline will execute and deliver the New Seco Pipeline Agreements;

(e) SNMP will (i) execute and deliver the LLC Agreement Amendment and (ii) take any and all actions necessary to cause (A) Catarina Midstream to execute and deliver the Catarina Gathering Amendment, (B) Seco Pipeline to execute and deliver the New Seco Pipeline Agreements, and (C) Xxxxxxx G&P to execute and deliver the Xxxxxxx Agreement Amendment and the NGL Sales Agreement Amendment;

(f) Targa will (i) execute and deliver the LLC Agreement Amendment and (ii) take any and all actions necessary to cause (A) Xxxxxxx G&P to execute and deliver the Xxxxxxx Agreement Amendment and the NGL Sales Agreement Amendment, and (B) Targa Liquids to execute and deliver the NGL Sales Agreement Amendment; and

(g) Each Party will execute and deliver a customary release to each other Party of all actions, causes of action, suits, debts, dues, sums of money, accounts, reckonings, contracts, damages, judgments, claims, and demands whatsoever, in law or equity, known or unknown, asserted or unasserted, which each Party ever had, now has or hereafter can, shall or may have, against any such other Party for, upon, or by reason of any matter, cause or thing whatsoever from the beginning of the world through the Closing Date, subject only to customary carve outs for obligations under this Agreement, the Assumption Agreements and any other agreements between or among the Parties or any affiliates of the Parties that have been or will be assumed, pursuant to 11 U.S.C. § 365, under the Plan. The releases will extend to each Party’s respective current and former officers, directors, managers, principals, members, partners, employees, agents, advisory board members, financial advisors, attorneys, accountants, investment bankers, consultants, representatives, and other professionals, in each case, solely in their capacity as such.

(h) Notwithstanding anything in this Agreement to the contrary, the execution and delivery prior to the Closing Date of any of the agreements, amendments, instruments, releases, or other documents required to be executed pursuant to this section 2.5.1 shall be for convenience only and shall have no legal force or effect in any respect prior to the Closing, and, if the Closing does not occur, all such agreements, amendments, instruments,

13

releases, or other documents required to be executed pursuant to this section 2.5.1 shall be deemed void ab initio and of no legal force or effect.

2.5.2 Assumption of Agreements. The Parties agree that, effective as of the Approval Date, each of the Assumption Agreements will be deemed assumed or otherwise ratified for all purposes under the Plan (but not amended by the applicable Amendment Agreements) and that, effective as of the Closing Date, each of the Assumption Agreements will be deemed assumed or otherwise ratified for all purposes under the Plan, in each case as amended by the applicable Amendment Agreements; provided, however, the terms of the Assumption Agreements, as amended by the applicable Amendment Agreements, will automatically be effective as of the Closing without regard for the timing of compliance with section 2.5.1. For the avoidance of doubt, the Parties agree that no payments will be due from any of the Debtors, including in respect of any Cure Claims (as defined in the Plan) that may be asserted by any Party, in connection with assumption or ratification of any of the Assumption Agreements pursuant to this section 2.5.2 or otherwise; provided, however, that the Parties agree that all performance and payment obligations, including with respect to minimum volume commitments, that exist under the Xxxxxxx Agreements and other agreements being assumed by the Debtors in accordance with this Agreement shall continue in full force and effect subject only to the specific modifications under this Agreement and the Amendment Agreements. For the avoidance of doubt, the Mitsui Letter Agreement will be one of the Assumption Agreements assumed by the Debtors.

2.6 Other Agreements of All Parties. Each of the Parties agrees to cooperate with each other Party and negotiate in good faith in connection with, and to exercise commercially reasonable efforts with respect to, the pursuit, approval of, and implementation of the Midstream Transaction and other covenants and agreements set forth herein, including the negotiation, drafting, execution, and delivery of the Amendment Agreements. Furthermore, subject to the terms hereof, each of the Parties agrees to take such action as may be reasonably necessary or reasonably requested by the other Parties to carry out the purposes and intent of this Agreement, and shall refrain from taking any action that would frustrate the purposes and intent of this Agreement.

ARTICLE 3

REPRESENTATIONS AND WARRANTIES

3.1 Representations and Warranties of the Debtors.

3.1.1 Each of the Debtors, severally (and not jointly and severally), represents and warrants to each of the other Parties hereto that the following statements are true, correct, and complete as of the Execution Date and as of the Closing:

(a) Each of the Debtors is validly existing and in good standing under the laws of the state of its incorporation or organization, and, subject to entry of the Approval Order, has all requisite corporate, partnership, limited liability company, or similar authority to enter into this Agreement and carry out the Midstream Transaction and other agreements contemplated hereby and to perform its obligations contemplated hereunder. Subject to entry of the Approval Order, the execution and delivery of this Agreement and the performance of such Debtor’s obligations hereunder have been duly authorized by all necessary corporate, limited liability company, partnership, or other similar action on its part.

14

(b) Subject to approval of the Bankruptcy Court, the execution, delivery and performance by such Debtor of this Agreement does not and will not (i) violate any material provision of law, rule, or regulation applicable to it or its charter or bylaws (or other similar governing documents) or (ii) conflict with, result in a breach of or constitute (with due notice or lapse of time or both) a default under any material contractual obligation to which it is a party, except any breach that may result from the rejection of the Rejection Agreements.

(c) The execution, delivery, and performance by such Debtor of this Agreement does not and will not require any material registration or filing with, consent or approval of, or notice to, or other action, with or by, any federal, state, or governmental authority or regulatory body, except the Bankruptcy Court.

(d) This Agreement is the legally valid and binding obligation of such Debtor, enforceable against it in accordance with its terms, except as enforcement may be limited by bankruptcy, insolvency, reorganization, moratorium, or other similar laws relating to or limiting creditors’ rights generally or by equitable principles relating to enforceability.

(e) Other than the Xxxxxx Gathering Agreement and the Mitsui Letter Agreement, there are no other agreements to which any of the Debtors is a party or by which any of the Debtors is bound that would reasonably be expected, following the Closing Date, to prevent or materially restrict the Debtors from delivering gas produced from the Comanche Acreage to Xxxxxxx G&P under the Comanche FGGPA (and the various Ratification Agreements by and among Xxxxxxx G&P, SN Maverick, and each of the Other Comanche Working Interest Holders pursuant to which the Other Comanche Working Interest Holders ratified the Comanche FGGPA).

3.1.2 Each of the Debtors, severally (and not jointly and severally), represents and warrants to each of the other Parties hereto that, as of the Approval Date, the Debtors have not taken or failed to take any actions during the period from the execution of this Agreement through the Approval Date that would have been violations of section 2.5.2 if the same had been taken (or failed to be taken) after the Approval Date.

3.2 Representations and Warranties of all Other Parties.

3.2.1 Each of the Parties other than the Debtors, solely with respect to itself, represents and warrants to each of the other Parties hereto (including each of the Debtors) that unless otherwise stated below, the following statements are true, correct, and complete as of the Execution Date and as of the Closing Date:

(a) Such Party is validly existing and in good standing under the laws of the state of its incorporation or organization, and has all requisite corporate, partnership, limited liability company, or similar authority to enter into this Agreement and carry out the Midstream Transaction and other agreements contemplated hereby and to perform its obligations contemplated hereunder. The execution and delivery of this Agreement and the performance of such Party’s obligations hereunder have been duly authorized by all necessary corporate, limited liability company, partnership, or other similar action on its part.

(b) The execution, delivery and performance by such Party of this Agreement will not, as of the Closing Date (i) violate any material provision of law, rule, or

15

regulation applicable to it or its charter or bylaws (or other similar governing documents), or (ii) conflict with, result in a breach of or constitute (with due notice or lapse of time or both) a default under any material contractual obligation to which it is a party.

(c) The execution, delivery, and performance by such Party of this Agreement does not and will not require any material registration or filing with, consent or approval of, or notice to, or other action, with or by, any federal, state, or governmental authority or regulatory body.

(d) This Agreement is the legally valid and binding obligation of such Party, enforceable against it in accordance with its terms, except as enforcement may be limited by bankruptcy, insolvency, reorganization, moratorium, or other similar laws relating to or limiting creditors’ rights generally or by equitable principles relating to enforceability.

3.2.2 Each of SNMP, Targa, and Xxxxxxx G&P, severally (and not jointly and severally), represents and warrants to each of the other Parties hereto that, as of the Execution Date, the form and substance of each of the LLC Agreement Amendment and the NGL Sales Agreement Amendment have been agreed upon in all respects by and among SNMP, Targa, Targa Liquids, and Xxxxxxx G&P.

ARTICLE 4

CONDITIONS PRECEDENT

4.1 Condition Precedent to all of the Parties’ Obligations. The Parties’ performance of their obligations set forth in this Agreement shall be subject to entry of the Approval Order.

4.2 Conditions Precedent to Midstream Transaction Closing. The respective obligations of each of the Parties to effect the Closing are subject to satisfaction of each of the following conditions precedent:

4.2.1 Each of the representations and warranties of the Parties contained in Article 3 that are made as of the Closing shall be true, correct, and complete as of the Closing.

4.2.2 The Bankruptcy Court shall have entered one or more orders approving the Debtors’ rejection of the following agreements in accordance with the Plan:

(a) the Marketing Agency Agreement; and

(b) the Midstream Agency Agreement.

4.2.3 With respect to each of the Brasada Processing Agreement, the ETC Processing Agreement, the Enterprise Purchase Agreement, or the Enterprise Transportation Agreement, the Bankruptcy Court shall have entered one or more orders (none of which shall be subject to a stay imposed by a court of competent jurisdiction) rejecting the Underlying Agreements or finding that the Underlying Agreement or Underlying Agreements do not continue to bind any of the Debtors in any material respect.

4.2.4 The Effective Date shall have occurred.

16

4.2.5 The Bankruptcy Court shall have entered the Approval Order.

4.2.6 On the Approval Date, the Parties shall have executed the Amendment Agreements pursuant to section 2.5.1.

4.3 Conditions Precedent to Debtors’ Obligations to Effect the Closing. The Debtors’ obligations to effect the Closing are subject to satisfaction of each of the following additional conditions precedent:

4.3.1 The Bankruptcy Court shall have entered one or more orders (none of which shall be subject to a stay imposed by a court of competent jurisdiction) approving the Debtors’ rejection of the following agreements in accordance with the Plan:

(a) the EFG Processing Agreement;

(b) the Interstate EFM Agreement; and

(c) the Intrastate EFM Agreement.

4.3.2 If any Rejection Litigation is commenced with respect to either the BP Oil Purchase Agreement or the Double Eagle Transportation Agreement, the Bankruptcy Court shall have entered one or more orders (none of which shall be subject to a stay imposed by a court of competent jurisdiction) finding that the Underlying Agreement or Underlying Agreements subject to any such claims, objections, causes of action, or other litigation do not continue to bind any of the Debtors in any material respect.

4.3.3 Each of the conditions precedent in sections 4.4 and 4.5 shall have been satisfied or waived pursuant to section 4.6.

4.3.4 The Debtors’ entry into an agreement on terms acceptable to the Debtors, to accept volumes of gas upon redelivery from Seco Pipeline in accordance with the New Seco Transportation Agreements.

4.4 Conditions Precedent to Targa’s and Xxxxxxx G&P’s Obligations to Effect the Closing. The obligations of Targa and Xxxxxxx G&P to effect the Closing are subject to satisfaction of each of the following additional conditions precedent:

4.4.1 None of the Bankruptcy Court’s orders described in sections 4.2.2 and 4.2.3 shall be subject to a stay imposed by a court of competent jurisdiction.

4.4.2 The Bankruptcy Court shall have entered one or more orders (none of which shall be subject to a stay imposed by a court of competent jurisdiction) approving the Debtors’ rejection of the following agreements (or otherwise finding that the Debtors are bound by any material obligations of), in each case, in accordance with the Plan:

(a) the EFG Processing Agreement; and

17

(b) to the extent applicable, any Other Xxxxxxx G&P Rejection Agreements. For the avoidance of doubt, SN Maverick shall not be required to reject the Mitsui Letter Agreement, and rejection of the Mitsui Letter Agreement is not required for the satisfaction of the condition precedent set forth in this section 4.4.2.

4.5 Conditions Precedent to SNMP’s, Catarina Midstream’s, and Seco Pipeline’s Obligations to Effect the Closing. The obligations of SNMP, Catarina Midstream, and Seco Pipeline to effect the Closing is subject to satisfaction of each of the following additional conditions precedent:

4.5.1 The Bankruptcy Court shall have entered one or more orders (none of which shall be subject to a stay imposed by a court of competent jurisdiction) approving the Debtors’ rejection of (or otherwise finding that the Debtors are not bound by any material obligations of) the following agreements in accordance with the Plan:

(a) the Interstate EFM Agreement; and

(b) the Intrastate EFM Agreement.

4.5.2 SN shall have confirmed that it has obtained all necessary consents under existing contractual arrangements and/or has otherwise secured all necessary contractual agreements from all Other Comanche Working Interest Holders in order to ensure the delivery for transportation and redelivery by Seco Pipeline in accordance with the terms of the New Comanche-Seco Agreement.

4.6 Waiver of Conditions Precedent. A condition precedent in this article 4 may be waived only by a written instrument executed by or on behalf of each of the Parties.

4.7 Closing Notice. Promptly following the satisfaction of all Closing Conditions Precedent and the Closing, the Parties shall execute and file the Closing Notice with the Bankruptcy Court.

ARTICLE 5

TERMINATION

5.1 Termination by Mutual Consent. This Agreement may be terminated and the Closing may be abandoned at any time prior to such Closing:

5.1.1 By mutual written consent of the Parties; or

5.1.2 At any time after the Closing Outside Date, by any Party by written notice to the other Parties, if (a) an order has not been entered rejecting the Marketing Agency Agreement and the Midstream Agency Agreement and directly or indirectly rejecting the Underlying Agreements (or finding that the Debtors are not bound by the Underlying Agreements) and (b) if the Closing has failed to occur on or before the Closing Outside Date; in each case, provided that no Party shall be entitled to terminate pursuant to this section 5.1.2 if such failure of the Closing to occur by the Closing Outside Date results primarily from (i) such Party’s breach of or failure to perform any material obligation under this Agreement, (ii) the failure of a material representation

18

or warranty of such Party in this Agreement, or (iii) the failure of a closing condition to be satisfied by the Closing Outside Date resulting primarily from actions taken or failed to be taken by such Party; for all purposes of this section 5.1.2 and section 5.1.3 (and only for purposes of this section 5.1.2 and section 5.1.3) (a) the Debtors will be considered a single Party, (b) Catarina Midstream, Seco Pipeline and SNMP will be considered a single Party, and (c) Targa and Xxxxxxx G&P will be considered a single Party; or

5.1.3 At any time after October 15, 2020, by any Party by written notice to the other Parties, if the Closing has failed to occur on or before such date; in each case, provided that no Party shall be entitled to terminate pursuant to this section 5.1.3 if such failure of the Closing to occur by the Closing Outside Date results primarily from (i) such Party’s breach of or failure to perform any material obligation under this Agreement, (ii) the failure of a material representation or warranty of such Party in this Agreement, or (iii) the failure of a closing condition to be satisfied by the Closing Outside Date resulting primarily from actions taken or failed to be taken by such Party.

ARTICLE 6

MISCELLANEOUS

6.1 Amendments and Waivers. This Agreement may be amended only upon written consent of each Party. Neither this Agreement nor any provisions hereof may be changed, waived, discharged, or terminated, nor may any consent to the departure from the terms hereof be given, orally (even if supported by new consideration), but only by an instrument in writing signed by each of the Parties to this Agreement. Any waiver or consent so given shall be effective only in the specified instance and for the specific purpose for which given.

6.2 Governing Law; Jurisdiction; Waiver of Jury Trial.

6.2.1 This Agreement shall be construed and enforced in accordance with, and the rights of the Parties shall be governed by, the laws of the State of Texas, without giving effect to the conflict of laws principles thereof. Each of the Parties irrevocably agrees that any legal action, suit, or proceeding arising out of or relating to this Agreement brought by any Party or its successors or assigns shall be brought and determined in the Bankruptcy Court, and each of the Parties hereby irrevocably submits to the jurisdiction of the Bankruptcy Court for itself and with respect to its property, generally and unconditionally, with regard to any such proceeding arising out of or relating to this Agreement or the Midstream Transaction. Each of the Parties agrees not to commence any proceeding relating hereto or to the Midstream Transaction or any of the other covenants or agreements set forth herein except in the Bankruptcy Court, other than proceedings in any court of competent jurisdiction to enforce any judgment, decree, or award rendered by the Bankruptcy Court. Each of the Parties further agrees that notice as provided in section 6.10 shall constitute sufficient service of process, and the Parties further waive any argument that such service is insufficient. Each of the Parties hereby irrevocably and unconditionally waives and agrees not to assert by way of motion or as a defense, counterclaim, or otherwise, in any legal action, suit, or proceeding arising out of or relating to this Agreement or the Midstream Transaction, (a) any claim that it is not personally subject to the jurisdiction of the Bankruptcy Court as described herein for any reason, (b) that it or its property is exempt or immune from jurisdiction of the Bankruptcy Court, or from any legal process commenced in the Bankruptcy

19

Court (whether through service of notice, attachment prior to judgment, attachment in aid of execution of judgment, execution of judgment or otherwise), or (c) that (i) a proceeding in the Bankruptcy Court is brought in an inconvenient forum, (ii) the venue of such proceeding is improper, or (iii) this Agreement, or the subject matter hereof, may not be enforced in or by the Bankruptcy Court, and each Party further consents to the entry of a Final Order by the Bankruptcy Court in the event that the Bankruptcy Court or another court of competent jurisdiction concludes that the Bankruptcy Court cannot or could not enter a final order or judgment consistent with Article III of the United States Constitution absent the consent of some or all of the Parties.

6.2.2 Each Party hereby waives, to the fullest extent permitted by applicable law, any right it may have to a trial by jury in any legal proceeding directly or indirectly arising out of or relating to this Agreement or the transactions contemplated hereby (whether based on contract, tort or any other theory).

6.3 Specific Performance/Remedies. Except as otherwise provided in section 2.2.1 with respect to the affirmative covenants (which section contains the exclusive remedy for breaches of section 2.2.1(a)(iii)), it is understood and agreed by the Parties that money damages would not be a sufficient remedy for any breach of this Agreement by any Party and each non-breaching Party shall be entitled to specific performance and injunctive or other equitable relief (including attorneys’ fees and costs) as a remedy for any such breach, without the necessity of proving the inadequacy of money damages as a remedy. Each Party hereby waives any requirement for the security or posting of any bond in connection with such remedies.

6.4 Survival. Notwithstanding the termination of this Agreement pursuant to Article 5, (a) sections 2.1, 2.4, 6.2, 6.3, 6.4, 6.6, 6.7, 6.8, 6.10, 6.11, 6.12, and 6.13 and, in the event of a termination in accordance with section 5.1, the remedy described in section 2.2.1(b)(i), shall survive such termination and shall continue in full force and effect in accordance with the terms hereof and (b) any liability of a Party for failure to comply with the terms of this Agreement shall survive such termination.

6.5 Successors and Assigns; Severability. Neither this Agreement nor any of the rights and obligations hereunder may be assigned or transferred by any Party (whether by operation of law or otherwise) without the prior written consent of each other Party. Any attempted assignment in violation of this section shall be void. This Agreement is intended to bind and inure to the benefit of the Parties and their respective successors, permitted assigns, heirs, executors, administrators, and representatives. If any provision of this Agreement, or the application of any such provision to any person or entity or circumstance, shall be held invalid or unenforceable, in whole or in part, such invalidity or unenforceability shall attach only to such provision or part thereof and the remaining part of such provision hereof and this Agreement shall continue in full force and effect. Upon any such determination of invalidity, the Parties shall negotiate in good faith to modify this Agreement so as to effectuate the original intent of the Parties as closely as possible in a reasonably acceptable manner in order that the transactions contemplated hereby are consummated as originally contemplated to the greatest extent possible.

6.6 Several, Not Joint, Obligations. Except as otherwise expressly stated in this Agreement, the agreements, representations, and obligations of the Parties pursuant to this Agreement are, in all respects, several and not joint or joint and several.

20

6.7 Relationship Among Parties. This Agreement shall be solely for the benefit of the Parties, and no other person or entity shall be a third-party beneficiary hereof.

6.8 Prior Negotiations; Entire Agreement. This Agreement, including all Exhibits, constitutes the entire agreement and understanding of the Parties and supersedes all other prior negotiations, agreements, or understandings, in each case with respect to the subject matter hereof.

6.9 Counterparts. This Agreement may be executed in several counterparts, each of which shall be deemed an original, and all of which together shall be deemed to be one and the same agreement. Execution copies of this Agreement delivered by facsimile or PDF shall be deemed originals for the purposes of this paragraph.

6.10 Notices. All notices hereunder shall be deemed given if in writing and delivered if sent by electronic mail, facsimile, courier, or by registered or certified mail (return receipt requested) to the following addresses and facsimile numbers:

6.10.1 If to the Debtors, to:

Xxxxxxx Energy Corporation

0000 Xxxx Xxxxxx

Xxxxx 0000

Xxxxxxx, Xxxxx 00000

Attention: Xxxxxxx Xxxxx

Email: xxxxxx@xxxxxxxxx.xxx

With a copy (which shall not constitute notice) to:

Xxxxxxxx & Xxxxxxxx LLP

000 Xxxx 00xx Xxxxxx

Xxx Xxxx, Xxx Xxxx 00000

Facsimile: (000) 000-0000

Attention: Xxxxxx X. Xxxxxxx and Xxxxx X. Xxxxxx

Email: xxxxxxxx@xxxx.xxx and xxxxxxx@xxxx.xxx

6.10.2 If to Catarina Midstream, to:

Catarina Midstream LLC

c/o/ Xxxxxxx Midstream Partners LP

0000 Xxxx Xxx Xxxx, Xxxxx 0000

Xxxxxxx, XX 00000

Attn: Chief Financial Officer

Email: xxxxx@xxxxxxxxxxxxxxxx.xxx

With a copy (which shall not constitute notice) to:

Hunton Xxxxxxx Xxxxx LLP

000 Xxxxxx Xxxxxx, Xxxxx 0000

00

Xxxxxxx, Xxxxx 00000

Attention: Xxx Xxxxxxxx and Xxxx Xxxxxx

Email: xxxxxxxxxxx@xxxxxxxx.xxx and xxxxxxx@xxxxxxxx.xxx

6.10.3 If to Xxxxxxx G&P, to:

TPL SouthTex Pipeline Company LP

000 X. 0xx Xxxxxx

Xxxxx 0000

Xxxxx, XX 00000

Attention: Xxx XxXxxxx

Email: xxxxxxxx@xxxxxxxxxxxxxx.xxx

With a copy (which shall not constitute notice) to:

TPL SouthTex Pipeline Company LP

000 X. 0xx Xxxxxx

Xxxxx 0000

Xxxxx, XX 00000

Attention: Xxxxx Xxxxxxx

Email: xxxxxxxx@xxxxxxxxxxxxxx.xxx

6.10.4 If to Seco Pipeline, to:

Seco Pipeline, LLC

c/x Xxxxxxx Midstream Partners LP

0000 Xxxx Xxx Xxxx, Xxxxx 0000

Xxxxxxx, XX 00000

Attn: Chief Financial Officer

Email: xxxxx@xxxxxxxxxxxxxxxx.xxx

With a copy (which shall not constitute notice) to:

Hunton Xxxxxxx Xxxxx LLP

000 Xxxxxx Xxxxxx, Xxxxx 0000

Xxxxxxx, Xxxxx 00000

Attention: Xxx Xxxxxxxx and Xxxx Xxxxxx

Email: xxxxxxxxxxx@xxxxxxxx.xxx and xxxxxxx@xxxxxxxx.xxx

6.10.5 If to SNMP, to:

Xxxxxxx Midstream Partners LP

0000 Xxxx Xxx Xxxx, Xxxxx 0000

Xxxxxxx, XX 00000

Attn: Chief Financial Officer

Email: xxxxx@xxxxxxxxxxxxxxxx.xxx

22

With a copy (which shall not constitute notice) to:

Hunton Xxxxxxx Xxxxx LLP

000 Xxxxxx Xxxxxx, Xxxxx 0000

Xxxxxxx, Xxxxx 00000

Attention: Xxx Xxxxxxxx and Xxxx Xxxxxx

Email: xxxxxxxxxxx@xxxxxxxx.xxx and xxxxxxx@xxxxxxxx.xxx

6.10.6 If to Targa, to:

TPL SouthTex Pipeline Company LP

000 X. 0xx Xxxxxx

Xxxxx 0000

Xxxxx, XX 00000

Attention: Xxx XxXxxxx

Email: xxxxxxxx@xxxxxxxxxxxxxx.xxx

With a copy (which shall not constitute notice) to:

TPL SouthTex Pipeline Company LP

000 X. 0xx Xxxxxx

Xxxxx 0000

Xxxxx, XX 00000

Attention: Xxxxx Xxxxxxx

Email: xxxxxxxx@xxxxxxxxxxxxxx.xxx

6.11 Settlement Discussions. This Agreement is part of a proposed settlement of matters that could otherwise be the subject of litigation among the Parties. Pursuant to Rule 408 of the Federal Rules of Evidence, any applicable state rules of evidence, and any other applicable law, foreign or domestic, this Agreement and all negotiations relating thereto shall not be admissible into evidence in any proceeding among the Parties other than a proceeding to enforce its terms. Notwithstanding anything in this Agreement to the contrary, nothing in this Agreement shall be deemed an admission that any agreement, document, contract, instrument, or unexpired lease is or is not an executory contract or unexpired lease within the meaning of 11 U.S.C. § 365 or otherwise, nor shall anything in this Agreement be deemed a waiver of any rights, claims, defenses, or objections with respect to the proper characterization of any agreement, document, contract, instrument, or unexpired lease under applicable law or under the Plan.

6.12 Limitation on Liability. Notwithstanding anything to the contrary contained in this Agreement, no Party shall be liable to any other Party or its affiliates, whether in contract, tort (including negligence and strict liability), or otherwise at law or in equity for any consequential, special, or punitive damages for any act or failure to act under any provision of this Agreement, even if advised of the possibility thereof.

6.13 Expenses. Except as expressly otherwise provided in this Agreement, whether or not the Closing takes place, all costs and expenses incurred in connection with this Agreement, the

23

Midstream Transaction, and the other transactions contemplated hereby shall be paid by the Party incurring such expense.

[Signature pages follow]

24

|

|

XXXXXXX ENERGY CORPORATION |

|

|

|

|

|

|

|

|

|

|

|

By: |

/s/ Xxxxxx Xxxxxx |

|

|

Name: |

Xxxxxx Xxxxxx |

|

|

Title: |

Chief Restructuring Officer |

|

|

SN PALMETTO, LLC |

|

|

|

|

|

|

|

|

|

|

|

By: |

XXXXXXX ENERGY CORPORATION, |

|

|

|

its sole member |

|

|

|

|

|

|

By: |

/s/ Xxxxxx Xxxxxx |

|

|

Name: |

Xxxxxx Xxxxxx |

|

|

Title: |

Chief Restructuring Officer |

|

|

XX XXXXXXX, LLC |

|

|

|

|

|

|

|

|

|

|

|

By: |

XXXXXXX ENERGY CORPORATION, |

|

|

|

its sole member |

|

|

|

|

|

|

By: |

/s/ Xxxxxx Xxxxxx |

|

|

Name: |

Xxxxxx Xxxxxx |

|

|

Title: |

Chief Restructuring Officer |

|

|

SN COTULLA ASSETS, LLC |

|

|

|

|

|

|

|

|

|

|

|

By: |

XXXXXXX ENERGY CORPORATION, |

|

|

|

its sole member |

|

|

|

|

|

|

By: |

/s/ Xxxxxx Xxxxxx |

|

|

Name: |

Xxxxxx Xxxxxx |

|

|

Title: |

Chief Restructuring Officer |

|

|

SN OPERATING, LLC |

|

|

|

|

|

|

|

|

|

|

|

By: |

XXXXXXX ENERGY CORPORATION, |

|

|

|

its sole member |

|

|

|

|

|

|

By: |

/s/ Xxxxxx Xxxxxx |

|

|

Name: |

Xxxxxx Xxxxxx |

|

|

Title: |

Chief Restructuring Officer |

|

|

SN TMS, LLC |

|

|

|

|

|

|

|

|

|

|

|

By: |

XXXXXXX ENERGY CORPORATION, |

|

|

|

its sole member |

|

|

|

|

|

|

By: |

/s/ Xxxxxx Xxxxxx |

|

|

Name: |

Xxxxxx Xxxxxx |

|

|

Title: |

Chief Restructuring Officer |

|

|

SN CATARINA, LLC |

|

|

|

|

|

|

|

|

|

|

|

By: |

XXXXXXX ENERGY CORPORATION, |

|

|

|

its sole member |

|

|

|

|

|

|

By: |

/s/ Xxxxxx Xxxxxx |

|

|

Name: |

Xxxxxx Xxxxxx |

|

|

Title: |

Chief Restructuring Officer |

|

|

ROCKIN L RANCH COMPANY, LLC |

|

|

|

|

|

|

|

|

|

|

|

By: |

XXXXXXX ENERGY CORPORATION, |

|

|

|

its sole member |

|

|

|

|

|

|

By: |

/s/ Xxxxxx Xxxxxx |

|

|

Name: |

Xxxxxx Xxxxxx |

|

|

Title: |

Chief Restructuring Officer |

|

|

SN PAYABLES, LLC |

|

|

|

|

|

|

|

|

|

|

|

By: |

XXXXXXX ENERGY CORPORATION, |

|

|

|

its sole member |

|

|

|

|

|

|

By: |

/s/ Xxxxxx Xxxxxx |

|

|

Name: |

Xxxxxx Xxxxxx |

|

|

Title: |

Chief Restructuring Officer |

|

|

SN EF MAVERICK, LLC |

|

|

|

|

|

|

|

|

|

|

|

By: |

XXXXXXX ENERGY CORPORATION, |

|

|

|

its sole member |

|

|

|

|

|

|

By: |

/s/ Xxxxxx Xxxxxx |

|

|

Name: |

Xxxxxx Xxxxxx |

|

|

Title: |

Chief Restructuring Officer |

|

|

SN UR HOLDINGS, LLC |

|

|

|

|

|

|

|

|

|

|

|

By: |

XXXXXXX ENERGY CORPORATION, |

|

|

|

its sole member |

|

|

|

|

|

|

By: |

/s/ Xxxxxx Xxxxxx |

|

|

Name: |

Xxxxxx Xxxxxx |

|

|

Title: |

Chief Restructuring Officer |

|

|

XXXXXXX MIDSTREAM PARTNERS GP LLC |

|

|

|

|

|

|

|

|

|

|

|

By: |

/s/ Xxxxxx X. Xxxxxxxxx |

|

|

Name: |

Xxxxxx X. Xxxxxxxxx |

|

|

Title: |

Chief Executive Officer |

|

|

XXXXXXX MIDSTREAM PARTNERS LP |

|

|

|

|

|

|

|

By: |

Xxxxxxx Midstream Partners GP LLC, |

|

|

|

its general partner |

|

|

|

|

|

|

By: |

/s/ Xxxxxx X. Xxxxxxxxx |

|

|

Name: |

Xxxxxx X. Xxxxxxxxx |

|

|

Title: |

Chief Executive Officer |

|

|

CATARINA MIDSTREAM, LLC |

|

|

|

|

|

|

|

By: |

Xxxxxxx Midstream Partners LP, |

|

|

|

its sole member |

|

|

|

|

|

|

By: |

Xxxxxxx Midstream Partners GP LLC, |

|

|

|

its general partner |

|

|

|

|

|

|

By: |

/s/ Xxxxxx X. Xxxxxxxxx |

|

|

Name: |

Xxxxxx X. Xxxxxxxxx |

|

|

Title: |

Chief Executive Officer |

|

|

SECO PIPELINE, LLC |

|

|

|

|

|

|

|

By: |

Xxxxxxx Midstream Partners LP, |

|

|

|

its sole member |

|

|

|

|

|

|

By: |

Xxxxxxx Midstream Partners GP LLC, |

|

|

|

its general partner |

|

|

|

|

|

|

By: |

/s/ Xxxxxx X. Xxxxxxxxx |

|

|

Name: |

Xxxxxx X. Xxxxxxxxx |

|

|

Title: |

Chief Executive Officer |

|

|

SP HOLDINGS, LLC |

|

|

|

|

|

|

|

By: |

SP Capital Holdings, LLC, |

|

|

|

its manager |

|

|

|

|

|

|

By: |

/s/ Xxxxxxx X. Xxxxxxx, III |

|

|

Name: |

Xxxxxxx X. Xxxxxxx, III |

|

|

Title: |

Manager |

|

|

XXXXXXX G&P LLC |

|

|

|

|

|

|

|

|

|

|

|

By: |

/s/ Xxxxxxx X. XxXxxxx |

|

|

Name: |

Xxxxxxx X. XxXxxxx |

|

|

Title: |

President |

|

|

TPL SOUTHTEX PROCESSING COMPANY LP |

|

|

|

|

|

|

|

By: |

TPL SouthTex Pipeline Company LLC, |

|

|

|

its general partner |

|

|

|

|

|

|

By: |

/s/ Xxxxxxx X. XxXxxxx |

|

|

Name: |

Xxxxxxx X. XxXxxxx |

|

|

Title: |

President – Gathering and Processing |

Exhibit A

Term Sheet

Midstream Agreement Summary1

Term Sheet

|

Xxxxxxx Agreement Amendment |

|

|

Xxxxxxx G&P Xxxxxxx Agreements G&P Rate

|

Upon satisfaction or waiver of all Closing Conditions Precedent, $[***] / Mcf escalated on June 1, 2021 and each year thereafter per existing contract,2 subject to the Continuing Requirement

o Gathering Fee = $[***] / Mcf o Processing Fee = $[***] / Mcf

Note: The fees in the agreements are on an MMBtu basis. The MMBtu to Mcf conversion factor of [***] MMBtu / Mcf is consistent with the current documents and current gross heating value of Catarina gas

All minimum volume commitments (“MVCs”) removed after May 2021 Consistent with existing agreement mechanisms, volumes are firm at the Silver Oak II Plant through remaining term of MVC, then are priority interruptible, with Raptor Plant volumes remaining priority interruptible Retention and clarification of existing netting mechanism across all Xxxxxxx Agreement fees and payments, per current practice |

|

Xxxxxxx G&P Xxxxxxx Agreements T&F Rate

|

Upon satisfaction or waiver of all Closing Conditions Precedent, $[***] / Gal, escalated on June 1, 2020 and thereafter per existing contract, subject to the Continuing Requirement |

|

Xxxxxxx G&P Xxxxxxx Agreements Adequate Assurance |

Credit Assurance o The amount of Credit Assurance (as described in the Xxxxxxx Agreements) will be SN Catarina’s anticipated obligations for the next 60 days x Xxxxxxx G&P will not be entitled to demand Credit Assurance until 180 days after the Second Installment Date. Following such time, Xxxxxxx G&P may demand Credit Assurance only if a Trigger has occurred o Triggers: (i) reasonable grounds for insecurity, (ii) SN Catarina is in a net payable position to Xxxxxxx G&P under the Xxxxxxx Agreements, as amended, in an amount greater than $1.0 Million, or (iii) SN Catarina is in Default o Credit Assurance, at SN Catarina’s election, can be in the form of a letter of credit, cash collateral, or prepayments o Credit Assurance posting will be within three business days (current agreement is just regular days) of written notice |

|

Xxxxxxx G&P Xxxxxxx Agreements Extension Option |

At expiration, SN Catarina may extend Xxxxxxx Agreements, as amended, every 12 months (by giving at least 180 days’ notice) for up to four additional 12-month terms at the then-current rates (escalated as described above in rows 1 and 2 of this Term Sheet) Xxxxxxx Agreements, as amended, terminate if not extended at SN Catarina’s option |

1 Capitalized terms used but not otherwise defined herein have the meanings ascribed to such terms in the Settlement Agreement to which this Term Sheet is annexed.

2 All references to existing contracts, agreements, terms, and practices refer to such contracts, agreements, terms, or practices existing as of May 22, 2020.

|

Catarina Gathering Amendment |

|

|

Catarina Midstream Catarina Natural Gas Gathering Rate |

Upon satisfaction or waiver of all Closing Conditions Precedent, $[***] / Mcf for all natural gas gathering, escalated at CPI only, per existing contract No MVCs |

|

Catarina Midstream Catarina Crude Oil Gathering Rate |

Upon satisfaction or waiver of all Closing Conditions Precedent, $[***] / Bbl for all crude oil gathering, escalated at CPI only, per existing contract |

|

Catarina Midstream Catarina Water Gathering Rate |

Upon satisfaction or waiver of all Closing Conditions Precedent, water rate of $[***] / Bbl |

|

Catarina Midstream Extension Option |

At expiration, SN Catarina may extend the Catarina Gathering Amendment, as amended, every 12 months (by giving at least 180 days’ notice) for up to four additional 12-month terms at the then-current rates (escalated at CPI only, per existing contract) Catarina Gathering Agreement, as amended, terminates if not extended at SN Catarina’s option |

|

Catarina Midstream Acreage Dedication

|

Eastern Catarina Acreage dedicated through October 2030 All existing dedications remain |

|

Catarina Midstream Other |

Catarina Midstream to provide SN Catarina a MFN on the Catarina Acreage for Natural Gas Gathering Rates, Oil Gathering Rates, and Water Gathering Rates on any new SN Catarina development after the Effective Date of the Plan |

|

New Seco Pipeline Agreements |

|

|

Seco Pipeline Residue Natural Gas Takeaway

|

$[***] / MMBtu via Seco Pipeline, escalated at CPI only No MVC; firm capacity set at maximum of Raptor Plant residue natural gas capacity or 200 MMBtu/d; SN Maverick and SN Catarina to dedicate all owned residue gas and use commercially reasonable efforts to cause all Raptor Plant tailgate residue gas to flow through Seco Pipeline |

2

Exhibit B

Other Xxxxxxx G&P Rejection Agreements

SN Catarina

None.

SN Maverick

None.