BUSINESS COMBINATION AGREEMENT by and among DEUTSCHE TELEKOM AG T-MOBILE GLOBAL ZWISCHENHOLDING GMBH T-MOBILE GLOBAL HOLDING GMBH T-MOBILE USA, INC. and METROPCS COMMUNICATIONS, INC. Dated as of October 3, 2012

Exhibit 2.1

EXECUTION COPY

by and among

DEUTSCHE TELEKOM AG

T-MOBILE GLOBAL ZWISCHENHOLDING GMBH

T-MOBILE GLOBAL HOLDING GMBH

T-MOBILE USA, INC.

and

METROPCS COMMUNICATIONS, INC.

Dated as of October 3, 2012

TABLE OF CONTENTS

Page | |||

ARTICLE I DEFINITIONS AND TERMS | 2 | ||

1.1 | Definitions | 2 | |

1.2 | Other Definitional Provisions | 19 | |

ARTICLE II RECAPITALIZATION; STOCK PURCHASE; CLOSING | 20 | ||

2.1 | The Recapitalization | 20 | |

2.2 | Stock Purchase | 26 | |

2.3 | Mergers | 27 | |

2.4 | Adjustment | 27 | |

2.5 | Closing | 29 | |

ARTICLE III REPRESENTATIONS AND WARRANTIES | 30 | ||

3.1 | Representations and Warranties Regarding DT, Global and Holding | 30 | |

3.2 | Representations and Warranties Regarding TMUS and its Subsidiaries | 33 | |

3.3 | Representations and Warranties of MetroPCS | 51 | |

ARTICLE IV COVENANTS | 73 | ||

4.1 | Interim Operations of TMUS | 73 | |

4.2 | Interim Operations of MetroPCS | 78 | |

4.3 | Proxy Statement | 83 | |

4.4 | MetroPCS Stockholders Meeting | 84 | |

4.5 | No Solicitation – MetroPCS | 84 | |

4.6 | No Solicitation – DT | 88 | |

4.7 | Access; Post-Signing Deliverables | 89 | |

4.8 | Publicity | 91 | |

4.9 | Expenses | 91 | |

4.10 | Resignations | 92 | |

4.11 | Filings; Other Actions; Notification. | 92 | |

4.12 | Financial Working Group | 93 | |

4.13 | Financing | 93 | |

4.14 | Regulatory Compliance | 95 | |

4.15 | Further Action | 95 | |

4.16 | Intercompany Arrangements | 96 | |

4.17 | Customer Communications | 96 | |

4.18 | Employee Matters | 96 | |

4.19 | MetroPCS Directors and Officers; Name | 97 | |

4.20 | Transition Arrangements | 98 | |

4.21 | Intellectual Property | 98 | |

4.22 | Confidentiality | 99 | |

4.23 | Indemnification; Release | 99 | |

4.24 | MetroPCS Common Stock | 100 | |

4.25 | Sale of Towers | 100 | |

4.26 | Notification of Certain Matters | 101 | |

i

TABLE OF CONTENTS

(continued)

Page | ||||

4.27 | Litigation | 101 | ||

4.28 | Anti-Takeover Statutes | 101 | ||

4.29 | Control of Operations | 101 | ||

4.30 | Listing of TMUS Stock Consideration | 102 | ||

ARTICLE V CONDITIONS | 102 | |||

5.1 | Conditions to Each Party’s Obligation to Effect the Transaction | 102 | ||

5.2 | Conditions to Obligations of MetroPCS | 103 | ||

5.3 | Conditions to Obligations of DT, Holding and TMUS | 104 | ||

ARTICLE VI TERMINATION | 106 | |||

6.1 | Termination | 106 | ||

6.2 | Effect of Termination and Abandonment | 107 | ||

ARTICLE VII MISCELLANEOUS AND GENERAL | 109 | |||

7.1 | Survival | 109 | ||

7.2 | Amendment; Waivers, Etc | 109 | ||

7.3 | Counterparts | 110 | ||

7.4 | Governing Law; Jurisdiction; Forum; Waiver of Trial by Jury | 110 | ||

7.5 | Notices | 110 | ||

7.6 | Entire Agreement | 112 | ||

7.7 | Specific Performance | 112 | ||

7.8 | No Third-Party Beneficiaries | 112 | ||

7.9 | Severability | 112 | ||

7.10 | Interpretation | 112 | ||

7.11 | Assignment | 112 | ||

7.12 | Limitation of Liability | 113 | ||

7.13 | Securities Matters | 113 | ||

7.14 | Transfer Taxes | 115 | ||

7.15 | Reliance of Other Parties | 115 | ||

7.16 | Effect of Breaches | 115 | ||

Exhibits

Exhibit A New MetroPCS Certificate

Exhibit B New MetroPCS Bylaws

Exhibit C Stockholder's Agreement

Exhibit D Trademark License

Exhibit E Voting and Support Agreement

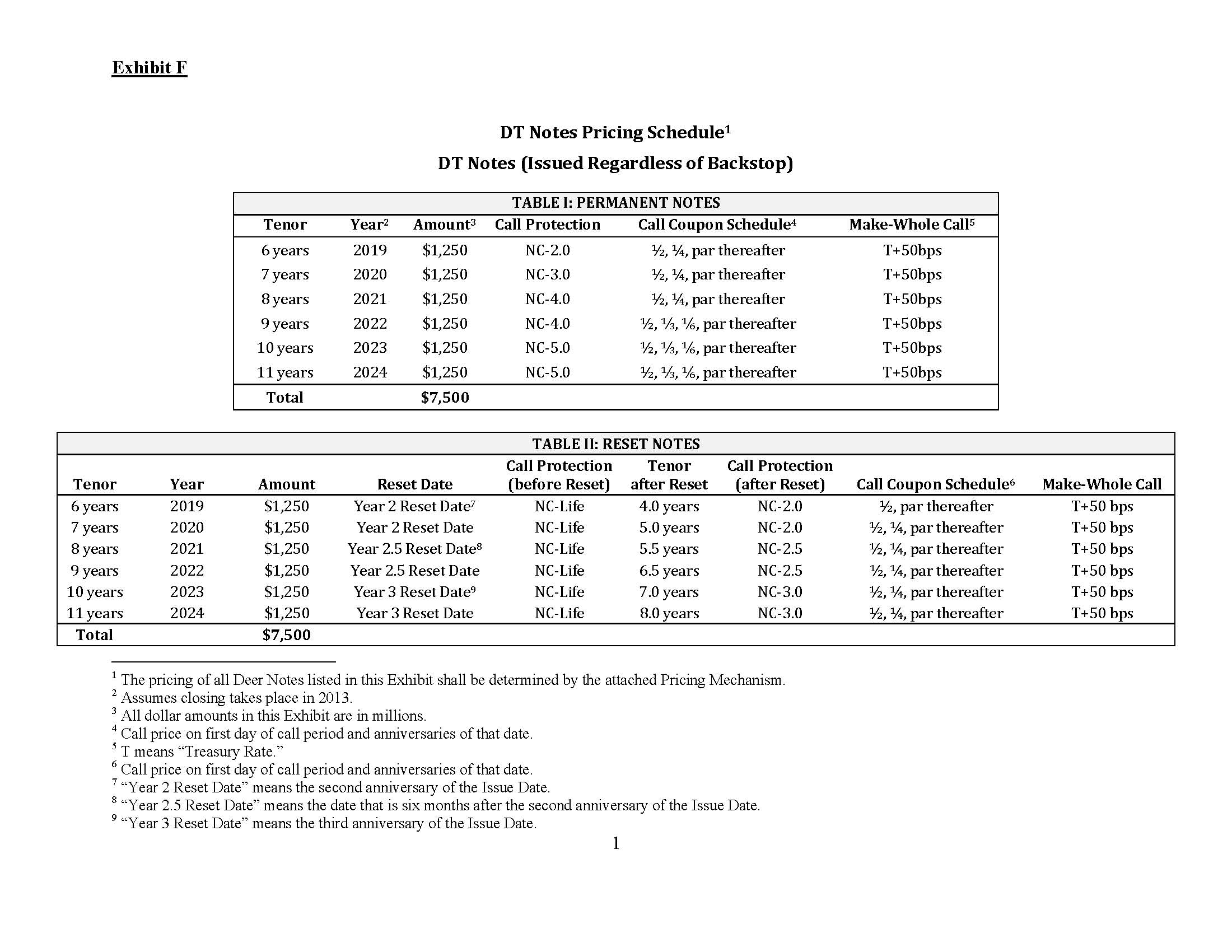

Exhibit F DT Note Pricing Schedule

Exhibit G Description of DT Notes

Exhibit H TMUS Working Capital Facility

Exhibit I DT Financing Backstop Commitment

Exhibit J Terms of Noteholder Agreement

Exhibit K Directors and Executive Officers

ii

BUSINESS COMBINATION AGREEMENT (this “Agreement”), dated as of October 3, 2012, by and among DEUTSCHE TELEKOM AG, an Aktiengesellschaft organized and existing under the laws of the Federal Republic of Germany (“DT”), T-MOBILE GLOBAL ZWISCHENHOLDING GMBH, a Gesellschaft mit beschränkter Haftung organized and existing under the laws of the Federal Republic of Germany (“Global”), T-MOBILE GLOBAL HOLDING GMBH, a Gesellschaft mit beschränkter Haftung organized and existing under the laws of the Federal Republic of Germany (“Holding”), T-MOBILE USA, INC., a Delaware corporation (“TMUS”), and METROPCS COMMUNICATIONS, INC., a Delaware corporation (“MetroPCS”).

RECITALS

WHEREAS, DT owns all of the issued and outstanding shares of capital stock of Global, which owns all of the issued and outstanding shares of capital stock of Holding, which owns all of the issued and outstanding shares of capital stock of TMUS;

WHEREAS, MetroPCS desires to effect a recapitalization and reverse split of its common stock, par value $0.0001 per share (the “MetroPCS Common Stock”), as described herein;

WHEREAS, in order to effect such recapitalization and the MetroPCS Reverse Stock Split, and to give effect to the other provisions herein and therein, MetroPCS desires to amend and restate its certificate of incorporation in the form attached as Exhibit A (the “New MetroPCS Certificate”) and its bylaws in the form attached as Exhibit B (the “New MetroPCS Bylaws”);

WHEREAS, as part of, and effective upon, such recapitalization and the MetroPCS Reverse Stock Split, MetroPCS desires to pay to its stockholders the MetroPCS Cash Amount, upon the terms and subject to the conditions set forth herein;

WHEREAS, upon, and subject to, such recapitalization, the MetroPCS Reverse Stock Split and the Cash Payment, Holding desires to sell to MetroPCS, and MetroPCS desires to purchase from Holding, the TMUS Shares in exchange for the TMUS Stock Consideration, upon the terms and subject to the conditions set forth herein;

WHEREAS, the MetroPCS Board has (a) approved the execution, delivery and performance of this Agreement, (b) determined that the New MetroPCS Certificate is advisable in connection with the Transaction in accordance with the provisions of the DGCL, and (c) resolved to recommend the approval of the New MetroPCS Certificate and the MetroPCS Share Issuance by the MetroPCS Stockholders, upon the terms and subject to the conditions set forth in this Agreement and in accordance with the provisions of the DGCL and the rules and regulations of the NYSE, as applicable;

WHEREAS, the execution, delivery and performance of this Agreement has been authorized by all requisite action of the board of directors or similar governing body of DT, Global, Holding and TMUS;

1

WHEREAS, concurrently with the Closing, and as a condition and inducement to the parties' willingness to enter into this Agreement, (a) DT and MetroPCS shall enter into a Stockholder's Agreement, dated as of the Closing Date, substantially in the form attached as Exhibit C (the “Stockholder's Agreement”), and (b) DT and MetroPCS shall enter into a Trademark License Agreement, dated as of the Closing Date, substantially in the form attached as Exhibit D (the “Trademark License” and, together with the Stockholder's Agreement, the “Ancillary Agreements”); and

WHEREAS, concurrently herewith, as a condition and inducement to the parties' willingness to enter into this Agreement, Madison Dearborn Capital Partners IV, L.P. is entering into a voting and support agreement in the form attached as Exhibit E.

NOW, THEREFORE, in consideration of the premises, and of the representations, warranties, covenants and agreements contained herein, and other good and valuable consideration the receipt and sufficiency of which are hereby acknowledged, the parties hereto, intending to be legally bound, hereby agree as follows:

ARTICLE I

DEFINITIONS AND TERMS

1.1 Definitions. As used in this Agreement the following terms shall have the following respective meanings:

“Actual Adjustment Amount” shall have the meaning set forth in Section 2.4(g).

“Additional DT Notes” shall have the meaning set forth in Section 4.13(c).

“Adjusted MetroPCS Stock Option” shall have the meaning set forth in Section 2.1(d)(i).

“Adjusted Per-Share Option Exercise Price” shall have the meaning set forth in Section 2.1(d)(i).

“Adjustment Amount” shall mean the sum of (i) the excess, if any, of $1,300,000,000 over the TMUS Working Capital as of 12:01 a.m., prevailing Eastern Time, on the Closing Date, plus (ii) the Spending Deficiency Amount.

“Affiliate” shall mean, with respect to any Person, a Person that directly or indirectly through one or more intermediaries, Controls, is Controlled by, or is under common Control with such Person.

“Agreement” shall have the meaning set forth in the Preamble.

“Ancillary Agreements” shall have the meaning set forth in the Recitals.

“Beneficially Own” shall mean, with respect to any securities, (i) having “beneficial ownership” of such securities for purposes of Rule 13d-3 or 13d-5 under the Exchange Act (or any successor statute or regulation), (ii) having the right to become the Beneficial Owner of

2

such securities (whether such right is exercisable immediately or only after the passage of time or the occurrence of conditions) pursuant to any agreement, arrangement or understanding, or upon the exercise of conversion rights, exchange rights, rights, warrants or options, or otherwise, or (iii) having an exercise or conversion privilege or a settlement payment or mechanism with respect to any option, warrant, convertible security, stock appreciation, swap agreement or other security, contract right or derivative position, whether or not currently exercisable, at a price related to the value of the securities for which Beneficial Ownership is being determined or a value determined in whole or part with reference to, or derived in whole or in part from, the value of the securities for which Beneficial Ownership is being determined that increases in value as the value of the securities for which Beneficial Ownership is being determined increases or that provides to the holder an opportunity, directly or indirectly, to profit or share in any profit derived from any increase in the value of the securities for which Beneficial Ownership is being determined (excluding any interests, rights, options or other securities set forth in Rule

16a-1(c)(1)-(5) or (7) promulgated pursuant to the Exchange Act).

“Business” shall mean the business of marketing, selling, offering, promoting or providing wireless telecommunications and wireless information products and services, and all products and services ancillary or related thereto, including products and services offered as of the date hereof by MetroPCS and its Subsidiaries, or TMUS and its Subsidiaries, as applicable, in the Territory.

“Business Day” shall mean any day other than a Saturday, a Sunday, a federal holiday or a day on which banks in the City of New York or in Bonn, Germany are authorized or obligated by Law to close.

“Cash Payment” shall have the meaning set forth in Section 2.1(c).

“CDMA” shall have the meaning set forth in Section 3.3(p)(ii)(I).

“Chosen Courts” shall have the meaning set forth in Section 7.4.

“Circumstance” shall mean any event, occurrence, fact, condition, effect, change or development.

“Closing” shall have the meaning set forth in Section 2.5.

“Closing Date” shall have the meaning set forth in Section 2.5.

“Code” shall have the meaning set forth in Section 3.2(g)(ii).

“Communications Act” shall have the meaning set forth in Section 3.1(c)(i).

“Confidentiality Agreement” shall mean, collectively, (i) the confidentiality agreement, dated January 31, 2012, between MetroPCS and TMUS, (ii) the Clean Team Confidentiality Agreement, dated April 19, 2012, between MetroPCS and TMUS, and (iii) the Common Interest Agreement, dated April 19, 2012, between MetroPCS and TMUS, in each case as amended, amended and restated, supplemented or modified from time to time.

3

“Control” shall mean the possession, direct or indirect, of the power to direct, or cause the direction of, the management and policies of a Person, whether through the ownership of voting securities, voting equity, limited liability company interests, general partner interests, or voting interests, by contract or otherwise.

“D&O Tail Policy” shall have the meaning set forth in Section 4.23(b).

“Damages” shall mean any and all demands, claims, actions or causes of action, assessments, losses, damages, liabilities, diminution in value, costs and expenses, including interest, penalties and reasonable attorneys' fees and expenses, in each case on a basis net of any actual benefit received.

“DT” shall have the meaning set forth in the Preamble.

“DT Notes” shall have the meaning set forth in Section 4.13(b).

“DT Termination Amount” shall have the meaning set forth in Section 6.2(d).

“DGCL” shall mean the General Corporation Law of the State of Delaware.

“Disputed Item” shall have the meaning set forth in Section 2.4(d).

“Effective Time” shall have the meaning set forth in Section 2.1(a).

“Encumbrance” (including, with correlative meaning, the term “Encumber”) shall mean any lien, pledge, charge, claim, encumbrance, hypothecation, security interest, option, lease, license, mortgage, easement or other restriction or third-party right of any kind, including any right of first refusal, tag-along or drag-along rights or restriction on voting, transferring, lending, disposing or assigning, in each case other than pursuant to the Stockholder's Agreement.

“Environmental Law” shall mean any applicable Law relating to (i) the protection of the environment (including air, water, soil and natural resources) or (ii) the use, storage, handling, release or disposal of any Hazardous Substance or waste, in each case as presently in effect.

“Equity Interests” shall mean (i) any capital stock of a corporation, any partnership interest, any limited liability company interest or any other equity interest; (ii) any security or right convertible into, exchangeable for, or evidencing the right to subscribe for, any such stock, equity interest or security referred to in clause (i); (iii) any stock appreciation right, contingent value right or similar security or right that is derivative of any such stock, equity interest or security referred to in clause (i) or (ii); and (iv) any contract to grant, issue, award, convey or sell any of the foregoing.

“ERISA” shall have the meaning set forth in Section 3.2(g)(i).

“ERISA Affiliate” means any entity that would be considered a single employer with TMUS under Section 4001(b) of ERISA or a member of a group of entities which includes TMUS for purposes of Section 414(b), (c), (m) or (o) of the Code.

4

“Estimated Adjustment Amount” shall have the meaning set forth in

Section 2.4(a).

“Estimated TMUS Closing Statement” shall have the meaning set forth in Section 2.4(a).

“Exchange Act” shall mean the Securities Exchange Act of 1934, as amended.

“Excluded Liabilities” shall mean all liabilities of DT and its Affiliates, other than liabilities of TMUS and its Subsidiaries to the extent related to the business operated by TMUS and its Subsidiaries on or prior to the Effective Time.

“Executory Period” shall have the meaning set forth in the definition of “Spending Deficiency Amount.”

“FAA” shall have the meaning set forth in Section 3.2(h)(ii).

“FAA Rules” shall have the meaning set forth in Section 3.2(h)(v).

“FCC” shall have the meaning set forth in Section 3.1(c)(i).

“FCC Licenses” shall mean the TMUS FCC Licenses and the MetroPCS FCC Licenses, as applicable.

“FCC Rules” shall have the meaning set forth in Section 4.14(a).

“Final Order” shall mean any action or decision of a Governmental Entity (i) that has not been vacated, reversed, set aside, annulled or suspended, (ii) as to which no request for a stay or similar request is pending, no stay is in effect, and any deadline for filing such request that may be designated by statute or regulation has passed without the filing of any such request, (iii) as to which no timely petition for rehearing or reconsideration, application for review, or other protest is pending before such Governmental Entity and the time for the filing of any such petition, application or protest designated by statute, regulation or otherwise has passed, (iv) that is not under reconsideration or review on such Governmental Entity's own motion and the time within which it may effect such reconsideration or review designated by statute, regulation or otherwise has passed, and (v) that is not then under administrative or judicial review and as to which there is no notice of appeal or other application for administrative or judicial review pending or in effect, and any deadline for filing any such appeal or other application for administrative or judicial review that may be designated by statute or rule has passed, unless, in the cases of clauses (ii) through (v), the parties mutually agree in writing that such request, stay, petition, application, protest, reconsideration, review, and/or appeal is not reasonably likely to result in vacating, reversing, setting aside, annulling or suspending such action or decision, or in modifying such action or decision in a manner that would reasonably be expected to have or result in a Regulatory Material Adverse Condition.

“Financing Sources” means the entities that commit to provide or otherwise enter into agreements, commitments, undertakings, contracts or arrangements in connection with or relating to the MetroPCS Finance Transactions or other financings in connection with or relating

5

to the Transaction, including any lenders, noteholders, agents, collateral agents, arrangers, trustees or similar parties.

“FMA” shall have the meaning set forth in Section 4.1(r).

“GAAP” shall mean United States generally accepted accounting principles.

“Global” shall have the meaning set forth in the Preamble.

“Governmental Consents” shall mean all notices, reports and other filings required to be made prior to the Closing by DT or MetroPCS or any of their respective Subsidiaries with, and all consents, registrations, approvals, permits, clearances, licenses, certificates, waivers and authorizations required to be obtained prior to the Closing by DT or MetroPCS or any of their respective Subsidiaries from, any Governmental Entity in connection with the execution and delivery of this Agreement and the consummation of the Transaction.

“Governmental Entity” shall have the meaning set forth in Section 3.1(c)(i).

“Hazardous Substance” shall mean any substance that is (i) listed, classified or regulated pursuant to any Environmental Law; (ii) any petroleum product or by-product, asbestos-containing material, lead-containing paint or plumbing, polychlorinated biphenyls, mold, radioactive material or radon; and (iii) any other substance which may be the subject of regulatory action by any Governmental Entity in connection with any Environmental Law.

“Hedge Agreement” shall mean any agreement or arrangement with respect to any swap, cap, collar, forward, future or derivative transaction or option or similar agreement, whether exchange traded, “over-the-counter” or otherwise, involving, or settled by reference to, one or more rates, currencies, commodities, equity or debt instruments or securities, or economic, financial or pricing indices or measures of economic, financial or pricing risk or value or any similar transaction or any combination of these transactions.

“Holding” shall have the meaning set forth in the Preamble.

“HSR Act” shall have the meaning set forth in Section 3.1(c)(i).

“In-the-Money MetroPCS Stock Option” shall have the meaning set forth in Section 2.1(d)(iii).

“Indebtedness” shall mean (i) all liabilities for borrowed money, whether current or funded, secured or unsecured, all obligations evidenced by bonds, debentures, notes or similar instruments, and all liabilities in respect of mandatorily redeemable or purchasable capital stock or securities convertible into capital stock; (ii) all liabilities for the principal amount of the deferred and unpaid purchase price of real property and equipment that have been delivered; (iii) all liabilities in respect of any lease of (or other arrangement conveying the right to use) real or personal property, or a combination thereof, which liabilities are required to be classified and accounted for under GAAP as capital leases; (iv) all liabilities in respect of Hedge Agreements; (v) all liabilities for the reimbursement of any obligor on any letter of credit, banker's acceptance or similar credit transaction securing obligations of any other Person of a type described in

6

clauses (i), (ii), (iii) or (iv) above to the extent of the obligation secured; and (vi) all liabilities as guarantor of obligations of any other Person of a type described in clauses (i), (ii), (iii), (iv) or (v) above, to the extent of the obligation guaranteed.

“Independent Accountant” shall mean a certified public accountant satisfactory to MetroPCS and DT; provided, that if MetroPCS and DT do not appoint an Independent Accountant within 10 days after either MetroPCS or DT gives notice to the other of a request therefor, either of them may request the American Arbitration Association to appoint as the Independent Accountant a partner in the New York office of a nationally recognized independent registered public accounting firm based on its determination that the partner has had no material relationships with the parties or their respective Affiliates within the preceding two years and taking into account such firm's material relationships during the preceding two years with the parties and their respective Affiliates, and such appointment shall be final, binding and conclusive on MetroPCS and DT.

“Insurance Policies” shall have the meaning set forth in Section 3.2(j).

“Insured Parties” shall have the meaning set forth in Section 4.23(b).

“Intellectual Property” shall mean all rights in intellectual property of any type throughout the world, including the following: (i) all trademarks, service marks, brand names, product names and slogans, certification marks, collective marks, d/b/a's, assumed names, Internet domain names, logos, symbols, trade dress, trade names and any and every other form of trade identity and other indicia of origin, all applications and registrations therefor and renewals thereof and all goodwill associated therewith and symbolized thereby (the items listed in this clause (i) collectively, “Trademarks”); (ii) all inventions and discoveries, whether or not reduced to practice, patents, including utility patents and design patents, industrial designs and utility models, invention disclosures, all applications and registrations for the foregoing, including reissues, divisionals, continuations, continuations-in-part, supplementary protection certificates, extensions, reexaminations, renewals thereof, and any counterparts (foreign or otherwise) claiming priority therefrom which priority may be claimed, and all inventions disclosed therein and improvements thereto; (iii) proprietary and confidential information, trade secrets and know-how, including processes, schematics, business methods, formulae, drawings, research and development, prototypes, models, designs, customer lists and supplier lists, all other confidential or proprietary technical, business and other information and all rights in any jurisdiction to limit the use or disclosure thereof (the items listed in this clause (iii) collectively, “Trade Secrets”); (iv) published and unpublished works of authorship (including databases and other compilations of information, mask works and Software), works for hire, the copyrights therein and thereto and all registrations and applications therefor and renewals, extensions, restorations and reversions thereof; and (v) all other intellectual property, industrial or similar proprietary rights recognized under any jurisdiction worldwide.

“Intercompany Contracts” shall mean all TMUS Contracts between TMUS or one or more of its Subsidiaries, on the one hand, and DT or one or more of its Subsidiaries (other than TMUS and its Subsidiaries), on the other hand, other than the DT Notes.

7

“Intercompany Indebtedness” shall mean any Indebtedness that would be owed by TMUS or one of its Subsidiaries to DT or one of its Subsidiaries (other than TMUS and its Subsidiaries) or by DT or one of its Subsidiaries (other than TMUS and its Subsidiaries) to TMUS or one of its Subsidiaries, other than the DT Notes, the Additional DT Notes or any indebtedness issued pursuant to Section 4.25.

“Intervening Event” shall mean a Circumstance material to MetroPCS and its Subsidiaries, taken as a whole, that did not occur, arise or become known to the MetroPCS Board or was not reasonably foreseeable by the MetroPCS Board, in each case prior to the date hereof (or if known or reasonably foreseeable prior to the date hereof, the material consequences of which were not known or reasonably foreseeable prior to the date hereof), which Circumstance, or any material consequence thereof, becomes known to the MetroPCS Board prior to the receipt of the MetroPCS Stockholder Approval; provided, however, that the receipt, existence or terms of a MetroPCS Acquisition Proposal shall not constitute an Intervening Event.

“IRS” shall have the meaning set forth in Section 3.2(g)(ii).

“IT Assets” shall mean computers, Software, firmware, middleware, servers, workstations, routers, hubs, switches, data communications lines and all other information technology equipment, and all documentation associated therewith.

“Knowledge of MetroPCS” shall mean the actual knowledge of the Persons listed on Schedule 1.1(a) of the MetroPCS Disclosure Letter.

“Knowledge of TMUS” shall mean the actual knowledge of the Persons listed on Schedule 1.1(a) of the TMUS Disclosure Letter.

“Laws” shall have the meaning set forth in Section 3.2(h)(i).

“Leased Real Property” shall mean all real property leased or subleased by TMUS and its Subsidiaries or by MetroPCS and its Subsidiaries, as applicable.

“Liabilities” means any and all debts, Indebtedness, liabilities, commitments and obligations of any kind, whether fixed, contingent or absolute, matured or unmatured, liquidated or unliquidated, accrued or not accrued, asserted or not asserted, known or unknown, determined, determinable or otherwise, whenever or however arising (including, whether arising out of any contract or tort based on negligence or strict liability) and whether or not the same would be required by GAAP to be reflected in financial statements or disclosed in the notes thereto.

“Licensed MHz POPs” shall mean, with respect to any FCC License, (i) the population of each geographic area covered by such FCC License based on the 0000 Xxxxxx Xxxxxx census, multiplied by (ii) the aggregate MHz of spectrum authorized by such FCC License in such area.

“Licenses” shall have the meaning set forth in Section 3.2(h)(i).

“Low Exercise Price MetroPCS Stock Option” shall have the meaning set forth in Section 2.1(d)(iii).

8

“Material MetroPCS Contracts” shall have the meaning set forth in

Section 3.3(p)(i).

“Material TMUS Contracts” shall have the meaning set forth in Section 3.2(o)(i).

“MetroPCS” shall have the meaning set forth in the Preamble.

“MetroPCS Acquisition Proposal” shall have the meaning set forth in

Section 4.5(j).

“MetroPCS Adverse Recommendation Change” shall have the meaning set forth in Section 4.5(d).

“MetroPCS Benefit Plans” shall have the meaning set forth in Section 3.3(h)(i).

“MetroPCS Board” shall mean the board of directors of MetroPCS.

“MetroPCS Book-Entry Shares” shall have the meaning set forth in

Section 2.1(f)(iii).

“MetroPCS Business Plan” shall mean MetroPCS's 2012 business plan approved by the MetroPCS Board prior to the date hereof and MetroPCS's 2013 long range planning model, a copy of each of which is attached as Schedule 1.1(b) of the MetroPCS Disclosure Letter.

“MetroPCS Cash Amount” shall have the meaning set forth in Section 2.1(c).

“MetroPCS Cash Deposit” shall have the meaning set forth in Section 2.1(e).

“MetroPCS Certificate” shall have the meaning set forth in Section 2.1(f).

“MetroPCS Closing Price” means the average, rounded to the nearest one ten thousandth, of the closing price of a share of MetroPCS Common Stock on the NYSE for the five full NYSE trading days immediately preceding the Closing Date, without giving effect to any adjustment for the MetroPCS Reverse Stock Split or the Cash Payment, whether through the operation of the NYSE's ex-dividend procedures or otherwise.

“MetroPCS Common Stock” shall have the meaning set forth in the Recitals.

“MetroPCS Communications Licenses” shall have the meaning set forth in Section 3.3(i)(ii).

“MetroPCS Consent Offers” shall mean any consent solicitations or similar transactions to secure the waiver of the holders of a majority in principal amount of each series of the MetroPCS Existing Notes to any “Change of Control” resulting from the Transaction or the transactions related thereto.

“MetroPCS Contract” shall mean any agreement, lease, license, contract, note, mortgage, credit agreement, security agreement, indenture, arrangement, commitment, undertak-

9

ing or other obligation, whether written or oral, binding upon MetroPCS or any of its Subsidiaries.

“MetroPCS Disclosure Letter” shall have the meaning set forth in Section 3.3.

“MetroPCS Employees” shall have the meaning set forth in Section 4.18(a).

“MetroPCS Exchange Ratio” shall have the meaning set forth in Section 2.1(a).

“MetroPCS Existing Credit Agreement” means the Third Amended and Restated Credit Agreement, dated as of March 17, 2011, among MetroPCS OpCo, as Borrower, the Lenders from time to time parties thereto, and JPMorgan Chase Bank, N.A., as Administrative Agent, as modified by the Incremental Commitment Agreement, dated as of May 10, 2011, among MetroPCS OpCo, as Borrower, the Guarantors (as defined therein), the financial institutions parties thereto and JPMorgan Chase Bank, N.A., as Administrative Agent, as further amended, amended and restated, supplemented or modified from time to time.

“MetroPCS Existing Finance Documents” means, collectively, (i) the Indenture, dated September 21, 2010, among MetroPCS OpCo, the Guarantors (as defined therein) and Xxxxx Fargo Bank, N.A., as trustee, the First Supplemental Indenture, dated September 21, 2010, among MetroPCS OpCo, the Guarantors and Xxxxx Fargo Bank, N.A., as trustee, and the Third Supplemental Indenture, dated December 23, 2010, among MetroPCS OpCo, the Guarantors and Xxxxx Fargo Bank, N.A., as trustee, and the “Notes” (as defined therein), (ii) the Indenture, dated September 21, 2010, among MetroPCS OpCo, the Guarantors (as defined therein) and Xxxxx Fargo Bank, N.A., as trustee, the Second Supplemental Indenture, dated November 17, 2010, among MetroPCS OpCo, the Guarantors (as defined therein) and Xxxxx Fargo Bank, N.A., as trustee, and the Fourth Supplemental Indenture, dated December 23, 2010, among MetroPCS OpCo, the Guarantors and Xxxxx Fargo Bank, N.A., as trustee, and the “Notes” (as defined therein), and (iii) the MetroPCS Existing Credit Agreement, together with the “Loan Documents” (as defined therein), in each case as amended, amended and restated, supplemented or modified from time to time.

“MetroPCS Existing Notes” means, collectively, MetroPCS OpCo's (i) 7 7/8% Senior Notes due 2018 and (ii) 6 5/8% Senior Notes due 2020.

“MetroPCS FCC Licenses” shall have the meaning set forth in Section 3.3(i)(ii).

“MetroPCS Finance Transactions” shall mean, collectively, (i) the issuance of the Permitted MetroPCS Notes, if any, (ii) the MetroPCS Consent Offers, if any, and (iii) other financing transactions, including hedging transactions, reasonably related to the foregoing as DT and MetroPCS may agree.

“MetroPCS Financial Statements” shall have the meaning set forth in

Section 3.3(f)(ii).

“MetroPCS HoldCo” shall mean MetroPCS, Inc.

10

“MetroPCS Material Adverse Effect” shall mean (i) an effect that would prevent or materially delay the ability of MetroPCS to consummate the Transaction, or (ii) a material adverse effect on the financial condition, properties, assets, liabilities, business or results of operations of MetroPCS and its Subsidiaries, taken as a whole; provided, however, with respect to this clause (ii), none of the following shall be deemed to be or constitute a MetroPCS Material Adverse Effect, or be taken into account when determining whether a MetroPCS Material Adverse Effect has occurred or would occur: (A) any Circumstance generally affecting (x) the Territory or global economy or Territory or global financial, debt, credit, capital or securities markets or (y) the wireless telecommunications and wireless information products and services industry in the Territory; (B) any Circumstance resulting from any declared or undeclared acts of war, terrorism, outbreaks or escalations of hostilities, sabotage or civil strife or threats thereof; (C) any act of God or weather-related Circumstance; (D) any Circumstance resulting from any change in (x) GAAP or (y) applicable Laws or regulatory or enforcement developments (in the cases of clauses (A), (B), (C) and (D)(y), except to the extent such Circumstance disproportionately affects MetroPCS and its Subsidiaries, taken as a whole, relative to other companies in the wireless telecommunications and wireless information services industry in the Territory, and, in the case of clause (D)(x), except to the extent such Circumstance disproportionately affects MetroPCS and its Subsidiaries, taken as a whole, relative to the prepaid operations of other companies in the wireless telecommunications and wireless information services industry in the Territory); (E) any Circumstance resulting from any failure by MetroPCS or its Subsidiaries to meet any estimates, projections, budgets or forecasts of revenues or earnings for any period ending on or after the date hereof, or any rumors, predictions or reports of such failure; provided, that the exception in this clause (E) shall not prevent or otherwise affect a determination that any Circumstance underlying such failure has resulted in or contributed to a MetroPCS Material Adverse Effect; (F) any Circumstance resulting from the announcement, pendency or public disclosure of this Agreement and the Transaction; (G) any Circumstance resulting from any action required to be taken or omitted to be taken pursuant to this Agreement; or (H) any Circumstance resulting from any decline in the price or trading volume of, MetroPCS Common Stock on the NYSE; provided, that the exception in this clause (H) shall not prevent or otherwise affect a determination that any Circumstance underlying such decline has resulted in or contributed to a MetroPCS Material Adverse Effect. Any determination of “MetroPCS Material Adverse Effect” shall exclude the effects of the matters disclosed in the MetroPCS Disclosure Letter or the matters specifically identified in the notes to the MetroPCS Financial Statements.

“MetroPCS Material Licenses” shall have the meaning set forth in

Section 3.3(i)(i).

“MetroPCS Merger” shall have the meaning set forth in Section 2.3(a).

“MetroPCS OpCo” shall mean MetroPCS Wireless, Inc..

“MetroPCS Owned Intellectual Property” shall have the meaning set forth in Section 3.3(o)(i).

“MetroPCS Per-Share Cash Amount” shall have the meaning set forth in Section 2.1(c).

11

“MetroPCS Permitted Encumbrances” shall mean (i) Encumbrances specifically reflected or specifically reserved against or otherwise disclosed in the MetroPCS Financial Statements or the MetroPCS Disclosure Letter; (ii) mechanics', materialmen's, warehousemen's, carriers', workers' or repairmen's liens or other common law or statutory Encumbrances arising or incurred in the ordinary course of MetroPCS's business consistent with past practice and that are not material in amount or effect on the business of MetroPCS and its Subsidiaries, taken as a whole; (iii) liens for Taxes, assessments and other governmental charges not yet due and payable or due but not delinquent or being contested in good faith by appropriate proceedings and for which adequate reserves have been established, if and to the extent required by GAAP, in the most recent MetroPCS Financial Statements; (iv) with respect to real property, (A) easements, quasi-easements, licenses, covenants, rights-of-way, rights of re-entry or other similar restrictions, including any other agreements, conditions or restrictions that would be shown by a current title report or other similar report or listing, in each case that do not or would not materially impair the conduct of business of MetroPCS and its Subsidiaries, taken as a whole, or the use or value of the relevant asset, (B) any conditions that may be shown by a current survey or physical inspection, in each case that do not or would not materially impair the conduct of business of MetroPCS and its Subsidiaries, taken as a whole, or the use or value of the relevant asset, and (C) zoning, building, subdivision or other similar requirements or restrictions, in each case that do not or would not materially impair the conduct of business of MetroPCS and its Subsidiaries, taken as a whole, or the use or value of the relevant asset; and (v) Encumbrances granted by or required under the MetroPCS Existing Finance Documents or any Hedge Agreements to which MetroPCS or any of its Subsidiaries is a party and which have been provided to DT prior to the date hereof.

“MetroPCS Preferred Stock” shall have the meaning set forth in Section 3.3(b)(i).

“MetroPCS Qualified Bidder” shall have the meaning set forth in Section 4.5(c).

“MetroPCS Recommendation” shall have the meaning set forth in Section 4.4(a).

“MetroPCS Restricted Stock” shall mean MetroPCS Common Stock issued, but not vested, under the MetroPCS Benefit Plans.

“MetroPCS Reverse Stock Split” shall have the meaning set forth in

Section 2.1(a).

“MetroPCS Rights Agreement” shall mean the Rights Agreement, dated as of March 29, 2007, between MetroPCS and American Stock Transfer & Trust Company, as Rights Agent.

“MetroPCS SEC Reports” shall mean such reports, schedules, forms, statements and other documents required to be filed by MetroPCS under the Exchange Act or any successor statute, and the rules and regulations promulgated thereunder, including pursuant to

Section 13(a) or 15(d) thereof, since December 31, 2009 (including the exhibits thereto and documents incorporated by reference therein).

“MetroPCS Share Issuance” shall have the meaning set forth in Section 2.2(b).

12

“MetroPCS State Licenses” shall have the meaning set forth in Section 3.3(i)(ii).

“MetroPCS Stock Option” shall have the meaning set forth in Section 2.1(d)(i).

“MetroPCS Stock Plans” shall have the meaning set forth in Section 2.1(d)(iv).

“MetroPCS Stockholder Approval” shall have the meaning set forth in

Section 3.3(d).

“MetroPCS Stockholders” shall mean the holders of MetroPCS Common Stock.

“MetroPCS Stockholders Meeting” shall have the meaning set forth in

Section 3.3(d).

“MetroPCS Subsequent Determination Notice” shall have the meaning set forth in Section 4.5(e).

“MetroPCS Superior Proposal” shall have the meaning set forth in Section 4.5(i).

“MetroPCS Superior Proposal Adverse Recommendation Change” shall have the meaning set forth in Section 4.5(e).

“MetroPCS Termination Amount” shall have the meaning set forth in

Section 6.2(b).

“New MetroPCS Bylaws” shall have the meaning set forth in the Recitals.

“New MetroPCS Certificate” shall have the meaning set forth in the Recitals.

“NYSE” shall mean the New York Stock Exchange.

“Order” shall have the meaning set forth in Section 5.1(d).

“Organizational Documents” shall mean, with respect to any Person, such Person's articles or certificate of association, incorporation, formation or organization, by-laws, limited liability company agreement, partnership agreement or other constituent document or documents, each in its currently effective form as amended from time to time.

“Owned Real Property” shall mean all real property owned in fee by TMUS and its Subsidiaries or by MetroPCS and its Subsidiaries, as applicable.

“Payment Agent” shall have the meaning set forth in Section 2.1(e).

“Permitted MetroPCS Notes” shall mean up to $3,500,000,000 (and up to an additional $2,000,000,000 to the extent necessary to satisfy the refinancing of any MetroPCS Existing Notes resulting from any change of control put obligations with respect thereto in connection with the Transaction) of fixed rate senior unsecured notes issued by MetroPCS HoldCo or MetroPCS OpCo in consultation with DT after the date hereof and on or prior to the Closing Date that (a) have a maturity date of not less than 7 and not more than 12 years from the date of

13

issuance thereof, (b) have a call protection pricing schedule that is customary for high yield debt securities, (c) have a non-call period for Permitted MetroPCS Notes (i) with maturities of 7 years, of not more than 3 years from the date of issuance, (ii) with maturities of greater than 7 years and not greater than 9 years, of not more than 4 years from the date of issuance, (iii) with maturities of greater than 9 years and not greater than 11 years, of not more than 5 years from the date of issuance, and (iv) with maturities of greater than 11 years, of not more than 6 years from the date of issuance, (d) have an effective yield to maturity, at time of issuance thereof (taking into account any issuance fees (including underwriting fees) or original issue discount thereon), that is not greater than the initial yield that would be applicable to DT Notes of the same tenor, if such DT Notes were to be issued on the same date as such Permitted MetroPCS Notes, as calculated in accordance with Exhibit F, (e) expressly permit the Transaction (without the need to obtain any waiver, pay any fee, or make any offer to purchase), and (f) are otherwise on the terms set forth in Exhibit G; provided, further, that the proceeds of any Permitted MetroPCS Notes shall be used solely as permitted under this Agreement.

“Person” shall mean any individual, corporation (including not-for-profit), general or limited partnership, limited liability company, joint venture, estate, trust, association, organization, Governmental Entity or other entity of any kind or nature.

“Proxy Statement” shall have the meaning set forth in Section 3.3(e)(i).

“PUCs” shall have the meaning set forth in Section 3.1(c)(i).

“Regulatory Law” shall mean (i) the Xxxxxxx Anti-Trust Act of 1890, as amended, (ii) the Xxxxxxx Act, as amended, (iii) the HSR Act, (iv) the Federal Trade Commission Act, as amended, (v) any Law analogous to the HSR Act or otherwise regulating antitrust or merger control matters and in each case existing in foreign jurisdictions, (vi) all other Federal, state and foreign, if any, statutes, rules, regulations, orders, decrees, administrative and judicial doctrines and other Laws that are designed or intended to prohibit, restrict or regulate (A) foreign investment or (B) actions having the purpose or effect of monopolization or restraint of trade or lessening of competition, (vii) the Communications Act, (viii) the FCC Rules, and (ix) the rules, regulations and orders of state public utility service or public utility commissions or similar state regulatory bodies.

“Regulatory Material Adverse Condition” shall have the meaning set forth in Section 4.11(c).

“Replacement Welfare Plan” shall have the meaning set forth in Section 4.18(b).

“Representatives” shall mean the directors, officers, employees, Affiliates, agents, investment bankers, financial advisors, attorneys, accountants, brokers, finders, consultants or representatives prior to the Closing of DT and its Subsidiaries or MetroPCS and its Subsidiaries, as applicable.

“Resolution Period” shall have the meaning set forth in Section 2.4(e).

“Restricted MetroPCS Contracts” shall have the meaning set forth in

Section 3.3(p)(ii).

14

“Restricted TMUS Contracts” shall have the meaning set forth in

Section 3.2(o)(ii).

“Sample TMUS Statement” shall mean the calculation set forth on

Schedule 1.1(b) of the TMUS Disclosure Letter of (i) the TMUS Working Capital as of June 30, 2012, including the asset and liability line items used in such calculation, (ii) the capital expenditures of TMUS and its Subsidiaries for the quarter ended June 30, 2012, including the line items used in such calculation, and (iii) the marketing, subscriber acquisition and subscriber retention expenditures of TMUS and its Subsidiaries for the first eight months of 2012, including the line items used in such calculation.

“Xxxxxxxx-Xxxxx Act” shall mean the Xxxxxxxx-Xxxxx Act of 2002.

“SEC” shall mean the United States Securities and Exchange Commission.

“Securities Act” shall mean the Securities Act of 1933, as amended.

“Software” shall mean computer software, programs and databases in any form, including Internet web sites, web site content, member or user lists and information associated therewith, links, source code, object code, binary code, operating systems, boot loaders, kernels, and specifications, data, databases, database management code, libraries, scripts, utilities, graphical user interfaces, menus, images, icons, forms, methods of processing, software engines, platforms, whether tangible, intangible, separate or embedded, and data formats, all versions, updates, corrections, enhancements, and modifications thereto, and all related documentation, developer notes, comments and annotations.

“Spending Deficiency Amount” shall mean an amount equal to the sum of (i) an amount (if positive) equal to (A) the number of full days elapsed from and including the date hereof through 12:01 a.m., prevailing Eastern Time, on the Closing Date (the “Executory Period”), multiplied by $9,442,000, minus (B) the amount of capital expenditures actually made or expensed by TMUS and its Subsidiaries in the Executory Period (as calculated based on the line items shown on the Sample TMUS Statement for TMUS and its Subsidiaries, in each case, determined in accordance with the accounting principles, practices and methodologies used in the TMUS Applicable Accounting Principles), plus (ii) an amount (if positive) equal to (A) the number of full days elapsed in the Executory Period, multiplied by $7,869,000, minus (B) the amount of expenditures actually made or expensed by TMUS and its Subsidiaries on marketing, subscriber acquisition and subscriber retention activities in the Executory Period (as calculated based on the line items shown on the Sample TMUS Statement for TMUS and its Subsidiaries, in each case, determined in accordance with the accounting principles, practices and methodologies used in the TMUS Applicable Accounting Principles).

“Stock Purchase” shall have the meaning set forth in Section 2.2(a).

“Stockholder's Agreement” shall have the meaning set forth in the Recitals.

“Subsidiary” shall mean, with respect to any Person, any entity, whether incorporated or unincorporated, of which (i) voting power to elect a majority of the board of directors or others performing similar functions with respect to such other Person is held by the first men-

15

tioned Person and/or by any one or more of its Subsidiaries, (ii) a general partnership interest is held by such first mentioned Person and/or by any one or more of its Subsidiaries (excluding partnerships where such first mentioned Person (A) does not Beneficially Own a majority of the general partnership interests or voting interests and (B) does not otherwise Control such entity, directly or indirectly, by contract, arrangement or otherwise), or (iii) in excess of 50% of the Equity Interests of such other Person is, directly or indirectly, owned or Controlled by such first mentioned Person and/or by any one or more of its Subsidiaries; provided, that for purposes hereof, Xxxx Inlet/VS GSM VII PCS Holdings, LLC shall be deemed to be a Subsidiary of TMUS, and provided, further, that for purposes hereof, Iowa Wireless Services LLC shall not be deemed to be a Subsidiary of TMUS.

“Tax” (including, with correlative meaning, the terms “Taxes” and “Taxable”) shall mean all United States federal, state and local and non-United States income, profits, franchise, gross receipts, environmental, customs duty, capital stock, severances, stamp, payroll, sales, employment, unemployment, disability, use, property, withholding, excise, production, value added, occupancy and other taxes, duties or assessments of any nature whatsoever, together with all interest, penalties and additions imposed with respect to such amounts and any interest in respect of such penalties and additions.

“Tax Return” shall mean all returns and reports (including elections, declarations, disclosures, schedules, estimates, and information returns) required to be supplied to a Taxing Authority relating to Taxes.

“Taxing Authority” means a Governmental Entity or any subdivision, agency, commission or authority thereof or any quasi-governmental or private body having jurisdiction over the assessment, determination, collection or imposition of any Tax (including the IRS).

“Termination Date” shall have the meaning set forth in Section 6.1(c).

“Territory” shall mean the United States, Puerto Rico, and the territories and protectorates of the United States.

“TMUS” shall have the meaning set forth in the Preamble.

“TMUS Applicable Accounting Principles” shall mean the accounting principles, practices and methodologies set forth in the Sample TMUS Statement or, to the extent not set forth or reflected therein, as used in TMUS Financial Statements for the fiscal year ended December 31, 2011.

“TMUS Acquisition Proposal” shall have the meaning set forth in Section 4.6(d).

“TMUS Benefit Plans” shall have the meaning set forth in Section 3.2(g)(i).

“TMUS Board” shall mean the board of directors of TMUS.

“TMUS Business Plan” shall mean TMUS's 2012 and 2013 business plan, a copy of which is attached as Schedule 1.1(c) of the TMUS Disclosure Letter.

16

“TMUS Closing Statement” shall have the meaning set forth in Section 2.4(b).

“TMUS Closing Statement Dispute Notice” shall have the meaning set forth in Section 2.4(d).

“TMUS Common Stock” shall have the meaning set forth in Section 3.2(b)(i).

“TMUS Communications Licenses” shall have the meaning set forth in Section 3.2(h)(ii).

“TMUS Contract” shall mean any agreement, lease, license, contract, note, mortgage, credit agreement, security agreement, indenture, arrangement, commitment, undertaking or other obligation, whether written or oral, binding upon TMUS or any of its Subsidiaries.

“TMUS Disclosure Letter” shall have the meaning set forth in Section 3.2.

“TMUS FCC Licenses” shall have the meaning set forth in Section 3.2(h)(ii).

“TMUS Financial Statements” shall have the meaning set forth in

Section 3.2(e)(i).

“TMUS Material Adverse Effect” shall mean (i) an effect that would prevent or materially delay the ability of DT, Holding or TMUS to consummate the Transaction, or (ii) a material adverse effect on the financial condition, properties, assets, liabilities, business or results of operations of TMUS and its Subsidiaries, taken as a whole; provided, however, with respect to this clause (ii), none of the following shall be deemed to be or constitute a TMUS Material Adverse Effect, or be taken into account when determining whether a TMUS Material Adverse Effect has occurred or would occur: (A) any Circumstance generally affecting (x) the Territory or global economy or Territory or global financial, debt, credit, capital or securities markets or (y) the wireless telecommunications and wireless information products and services industry in the Territory; (B) any Circumstance resulting from any declared or undeclared acts of war, terrorism, outbreaks or escalations of hostilities, sabotage or civil strife or threats thereof; (C) any act of God or weather-related Circumstance; (D) any Circumstance resulting from any change in GAAP or applicable Laws or regulatory or enforcement developments (in the cases of clauses (A), (B), (C) and (D), except to the extent such Circumstance disproportionately affects TMUS and its Subsidiaries, taken as a whole, relative to other companies in the wireless telecommunications and wireless information services industry in the Territory); (E) any Circumstance resulting from any failure by TMUS or its Subsidiaries to meet any estimates, projections, budgets or forecasts of revenues or earnings for any period ending on or after the date hereof, or any rumors, predictions or reports of such failure; provided, that the exception in this clause (E) shall not prevent or otherwise affect a determination that any Circumstance underlying such failure has resulted in or contributed to a TMUS Material Adverse Effect; (F) any Circumstance resulting from any action required to be taken or omitted to be taken pursuant to this Agreement; or (G) any Circumstance resulting from the announcement, pendency or public disclosure of this Agreement and the Transaction. Any determination of “TMUS Material Adverse Effect” shall exclude the effects of the matters disclosed in the TMUS Disclosure Letter or the matters specifically identified in the notes to the TMUS Financial Statements.

17

“TMUS Material Licenses” shall have the meaning set forth in Section 3.2(h)(i).

“TMUS Merger” shall have the meaning set forth in Section 2.3(b).

“TMUS Owned Intellectual Property” shall have the meaning set forth in Section 3.2(n)(i).

“TMUS Permitted Encumbrances” shall mean (i) Encumbrances reflected or reserved against or otherwise disclosed in the TMUS Financial Statements or the TMUS Disclosure Letter; (ii) mechanics', materialmen's, warehousemen's, carriers', workers' or repairmen's liens or other common law or statutory Encumbrances arising or incurred in the ordinary course of TMUS's business consistent with past practice and that are not material in amount or effect on the business of TMUS and its Subsidiaries, taken as a whole; (iii) liens for Taxes, assessments and other governmental charges not yet due and payable or due but not delinquent or being contested in good faith by appropriate proceedings and for which adequate reserves have been established if and to the extent required by GAAP, in the most recent TMUS Financial Statements; and (iv) with respect to real property, (A) easements, quasi-easements, licenses, covenants, rights-of-way, rights of re-entry or other similar restrictions, including any other agreements, conditions or restrictions that would be shown by a current title report or other similar report or listing, in each case that do not or would not materially impair the conduct of business of TMUS and its Subsidiaries, taken as a whole, or the use or value of the relevant asset, (B) any conditions that may be shown by a current survey or physical inspection, in each case that do not or would not materially impair the conduct of business of TMUS and its Subsidiaries, taken as a whole, or the use or value of the relevant asset, and (C) zoning, building, subdivision or other similar requirements or restrictions, in each case that do not or would not materially impair the conduct of business of TMUS and its Subsidiaries, taken as a whole, or the use or value of the relevant asset.

“TMUS Shares” shall mean all of the Equity Interests of TMUS.

“TMUS State Licenses” shall have the meaning set forth in Section 3.2(h)(ii).

“TMUS Stock Consideration” shall have the meaning set forth in Section 2.2(b).

“TMUS Working Capital” means, for the applicable date and time, (a) the sum of the amounts for the asset line items shown on the Sample TMUS Statement for TMUS and its Subsidiaries, minus (b) the sum of the amounts for the liability line items shown on the Sample TMUS Statement for TMUS and its Subsidiaries, in each case, determined in accordance with the accounting principles, practices and methodologies used in the TMUS Applicable Accounting Principles.

“TMUS Working Capital Facility” shall mean a revolving credit facility made available by DT (or one of its Subsidiaries if the obligations of such Subsidiary thereunder are unconditionally guaranteed by DT) for the benefit of TMUS and its Subsidiaries, for working capital and other general corporate purposes, with a maximum principal amount of no less than $500,000,000, which facility shall be on terms and conditions substantially as set forth on Exhibit H and otherwise reasonably acceptable to DT and MetroPCS.

18

“Tower Assets” means (i) the Owned Real Property and Leased Real Property owned or leased by TMUS or any of its Subsidiaries that have, as fixtures or appurtenances thereto, cellular transmission towers or building pads therefor owned or leased by TMUS or its Subsidiaries, but excluding any retail stores, business offices or any location where TMUS and its Subsidiaries do not have any facilities operating on TMUS FCC Licenses, and (ii) such cellular transmission towers and building pads therefor, all as set forth in Schedule 1.1(d) of the TMUS Disclosure Letter.

“Tower Holdco” shall have the meaning set forth in Section 4.25.

“Trade Secrets” shall have the meaning set forth in the definition of “Intellectual Property.”

“Trademarks” shall have the meaning set forth in the definition of “Intellectual Property.”

“Trademark License” shall have the meaning set forth in the Recitals.

“Transaction” shall mean the transactions contemplated by this Agreement.

“Transfer Taxes” shall mean any and all transfer Taxes (excluding Taxes measured in whole or in part by net income or gain), including sales, use, excise, stock, stamp, documentary, filing, real estate transfer, recording, permit, license, authorization and similar Taxes.

“Unresolved Items” shall have the meaning set forth in Section 2.4(f).

“Voting Debt” shall have the meaning set forth in Section 3.2(b)(ii).

“WARN Act” shall have the meaning set forth in Section 3.2(m)(v).

1.2 Other Definitional Provisions. Unless the express context otherwise requires:

(a) the words “hereof”, “herein”, and “hereunder” and words of similar import, when used in this Agreement, shall refer to this Agreement as a whole and not to any particular provision of this Agreement;

(b) the words “date hereof”, when used in this Agreement, shall refer to the date set forth in the Preamble;

(c) the terms defined in the singular have a comparable meaning when used in the plural, and vice versa;

(d) the terms defined in the present tense have a comparable meaning when used in the past tense, and vice versa;

(e) any references herein to “Dollars” and “$” are to United States Dollars;

19

(f) any references herein to a specific Section, Schedule, Annex or Exhibit shall refer, respectively, to Sections, Schedules, Annexes or Exhibits of this Agreement;

(g) wherever the word “include”, “includes”, or “including” is used in this Agreement, it shall be deemed to be followed by the words “without limitation”;

(h) references herein to any gender includes each other gender;

(i) the word “or” shall not be exclusive; and

(j) references to documents or other materials “provided,” “delivered” or “made available” to DT, TMUS or MetroPCS, as applicable, shall mean that such documents or other materials were present prior to the execution and delivery of this Agreement in the on-line data room maintained for purposes of the Transaction by DT, TMUS or MetroPCS, as applicable, and accessible by the other parties or their Representatives.

ARTICLE II

RECAPITALIZATION; STOCK PURCHASE; CLOSING

2.1 The Recapitalization. On the Closing Date, MetroPCS shall undertake a recapitalization as follows:

(a) Amendment of Certificate of Incorporation; Reverse Stock Split. Upon the terms and subject to the conditions set forth in this Agreement, MetroPCS shall effect a reverse stock split, pursuant to which each share of MetroPCS Common Stock outstanding as of the Effective Time shall thereafter represent 0.5 of a share of MetroPCS Common Stock (the “MetroPCS Exchange Ratio”) (the “MetroPCS Reverse Stock Split”), by filing a Certificate of Amendment with the Secretary of State of the State of Delaware, providing for the amendment and restatement of the Certificate of Incorporation of MetroPCS in the form of the New MetroPCS Certificate. The New MetroPCS Certificate shall be the Certificate of Incorporation of MetroPCS from and after the Effective Time, until thereafter changed or amended as provided therein and/or in accordance with its provisions and applicable Law (the date and time the New MetroPCS Certificate becomes effective, the “Effective Time”).

(b) Amendment of Bylaws. MetroPCS shall take all actions necessary so that, effective as of the Effective Time, the amended Bylaws of MetroPCS shall be amended and restated in the form of the New MetroPCS Bylaws, which shall be the Bylaws of MetroPCS from and after the Effective Time, until thereafter changed or amended as provided therein, in the New MetroPCS Certificate and/or in accordance with applicable Law.

(c) Cash Payment. As part of the recapitalization of MetroPCS, subject to the terms and conditions set forth in this Agreement, and conditioned upon the effectiveness of the MetroPCS Reverse Stock Split, effective immediately following the Effective Time, MetroPCS shall make a payment (the “Cash Payment”) in cash in an amount equal to $1,500,000,000, without interest, in the aggregate (the “MetroPCS Cash Amount”), to the MetroPCS Stockholders of record immediately following the Effective Time, by paying to each such MetroPCS Stockholder an amount per share of MetroPCS Common Stock held of record by such holder immediately following the Effective Time (with the number of shares of MetroPCS Common Stock held by

20

such holder, for the avoidance of doubt, taking into account the MetroPCS Reverse Stock Split) equal to the MetroPCS Cash Amount divided by the aggregate number of shares of MetroPCS Common Stock (with the number of shares of MetroPCS Common Stock, for the avoidance of doubt, taking into account the MetroPCS Reverse Stock Split) outstanding immediately following the Effective Time (the “MetroPCS Per-Share Cash Amount”). The amount to be paid to each holder of record of MetroPCS Common Stock immediately following the Effective Time shall be rounded up to the nearest whole cent.

(d) MetroPCS Equity and Equity-Based Awards.

(i) Effective as of the Effective Time, and except as otherwise provided in Section 2.1(d)(iii), each then outstanding option to purchase shares of MetroPCS Common Stock (each, a “MetroPCS Stock Option”) granted to or held by any current or former employee, officer or director of, or consultant or other service provider to, MetroPCS or any of its Affiliates shall be adjusted such that (A) it shall become an option to purchase a number (rounded down to the nearest whole number) of shares of MetroPCS Common Stock (an “Adjusted MetroPCS Stock Option”) equal to the product of (1) the number of shares of MetroPCS Common Stock subject to such MetroPCS Stock Option immediately prior to the MetroPCS Reverse Stock Split, multiplied by (2) the MetroPCS Exchange Ratio, and (B) the per share exercise price for MetroPCS Common Stock issuable upon the exercise of such Adjusted MetroPCS Stock Option shall be adjusted to be equal to (rounded up to the nearest cent) (x) the quotient of (1) the exercise price per share of MetroPCS Common Stock for which such MetroPCS Stock Option was exercisable immediately prior to the MetroPCS Reverse Stock Split, divided by (2) the MetroPCS Exchange Ratio, less (y) the MetroPCS Per-Share Cash Amount (such adjusted per-share exercise price, the “Adjusted Per-Share Option Exercise Price”). Except as otherwise provided in this Section 2.1(d)(i) and in Section 2.1(d)(ii), each Adjusted MetroPCS Stock Option shall be subject to the same terms and conditions (including expiration dates and exercise provisions, taking into account, to the extent applicable, Section 2.1(d)(ii) and Section 2.1(d)(iv)), as were applicable to the corresponding MetroPCS Stock Option immediately prior to the Effective Time. This Section 2.1(d)(i) is intended to comply with Section 409A (and, to the extent applicable by reason of Section 409A, Section 424) of the Code and the Treasury Regulations issued thereunder and will be interpreted accordingly.

(ii) Effective as of the consummation of the Stock Purchase, each then outstanding MetroPCS Stock Option (whether or not converted into an Adjusted MetroPCS Stock Option) shall automatically and without any action on behalf of the holder thereof, immediately vest and become exercisable in accordance with its terms.

(iii) Notwithstanding Section 2.1(d)(i), (x) each MetroPCS Stock Option (other than any Low Exercise Price MetroPCS Stock Option) with an exercise price per share immediately prior to the Effective Time (ignoring any adjustment for the MetroPCS Reverse Stock Split or the Cash Payment, including pursuant to Section 2.1(d)(i)) that is less than the MetroPCS Closing Price (an “In-the-Money MetroPCS Stock Option”) shall, at the written election, as to all or any portion of such In-the-Money MetroPCS Stock Option, of the holder of such In-the-Money MetroPCS Stock Option made no later than five

21

Business Days after the consummation of the Stock Purchase, and (y) each MetroPCS Stock Option granted under the Second Amended & Restated 1995 Stock Option Plan of MetroPCS that, if it were adjusted pursuant to Section 2.1(d)(i), would have an Adjusted Per-Share Option Exercise Price that is less than or equal to zero (a “Low Exercise Price MetroPCS Stock Option”), shall, automatically and without any action on behalf of the holder thereof, in each case of (x) and (y) in lieu of becoming an Adjusted MetroPCS Stock Option, be cancelled and converted, effective as of the consummation of the Stock Purchase, into the right to receive from MetroPCS, as promptly as reasonably practicable and in any event no later than 10 Business Days after the Closing Date, in full settlement of such holder's right thereunder, an amount in cash, without interest, equal to (A) the product of (1) the aggregate number of shares of MetroPCS Common Stock subject to such In-the-Money MetroPCS Stock Option (or portion thereof) for which the holder has elected to receive cash pursuant to this Section 2.1(d)(iii) or Low Exercise Price MetroPCS Stock Option, as applicable, immediately prior to the Effective Time (and in each case ignoring any adjustment for the MetroPCS Reverse Stock Split and the Cash Payment, including pursuant to Section 2.1(d)(i)), multiplied by (2) the amount by which the MetroPCS Closing Price exceeds the exercise price per share of such In-the-Money MetroPCS Stock Option (or portion thereof) for which the holder has elected to receive cash pursuant to this Section 2.1(d)(iii) or Low Exercise Price MetroPCS Stock Option, as applicable, immediately prior to the Effective Time (and in each case ignoring any adjustment for the MetroPCS Reverse Stock Split and the Cash Payment, including pursuant to Section 2.1(d)(i)), less (B) any Taxes required to be withheld from such payment.

(iv) For the avoidance of doubt, the MetroPCS Reverse Stock Split and Cash Payment contemplated by this Section 2.1 shall be deemed for all purposes of the MetroPCS Benefit Plans (including each of MetroPCS's equity-based compensation plans, as amended, identified on Schedule 3.3(h) of the MetroPCS Disclosure Letter (the “MetroPCS Stock Plans”)) to have occurred contingent upon the consummation of the Stock Purchase such that, (A) there shall be a “Change in Control”, “Change of Control” and “Corporate Transaction”, as applicable, at the time of the consummation of the Stock Purchase under and pursuant to the terms of the MetroPCS Benefit Plans (including the MetroPCS Stock Plans) and (B) all severance, accelerated vesting, lapsing of restrictions and other rights and benefits that accrue and become effective under the MetroPCS Benefit Plans (including the MetroPCS Stock Plans) upon a “Change in Control”, “Change of Control” and “Corporation Transaction”, as applicable, as a result of the Transaction shall accrue and become effective as of the consummation of the Stock Purchase pursuant to such MetroPCS Benefit Plans (including the MetroPCS Stock Plans) and the provisions hereof. For the further avoidance of doubt, the MetroPCS Reverse Stock Split and Cash Payment shall together be deemed to constitute a “recapitalization” under each of the MetroPCS Stock Plans, and the applicable provisions of each such MetroPCS Stock Plan shall be construed accordingly. At or prior to the consummation of the Stock Purchase, the MetroPCS Board (or the appropriate committee thereof) and the boards of directors or management committees of its Subsidiaries shall pass such resolutions as may be necessary to effectuate the provisions of this

Section 2.1(d), including to (x) ensure that all MetroPCS Stock Options that are not converted into Adjusted MetroPCS Stock Options are cashed out and cancelled effective as of the consummation of the Stock Purchase pursuant to Section 2.1(d)(iii) (and the MetroPCS Stock Plans are hereby deemed amended

22

to the extent necessary to effectuate the provisions of this Section 2.1(d)) and that no holder of any such cashed-out and cancelled MetroPCS Stock Option shall have any right with respect thereto, except as provided in this Section 2.1(d) and (y) amend the award agreements with respect to any MetroPCS Restricted Stock to permit the holder of such MetroPCS Restricted Stock to receive and keep the Cash Payment contemplated by this Section 2.1.

(v) Prior to the Effective Time, MetroPCS shall deliver to each holder of the MetroPCS Stock Options appropriate notices and, if applicable, election forms, setting out the terms applicable to such MetroPCS Stock Options with respect to the Transaction.

(e) Payment Agent; Deposit of MetroPCS Cash Amount. At or prior to the Effective Time, MetroPCS shall deposit, or shall cause to be deposited, with a commercial bank or trust company designated by MetroPCS and reasonably satisfactory to DT (the “Payment Agent”) for the benefit of the MetroPCS Stockholders of record immediately following the Effective Time, (i) cash in lieu of any fractional shares, to be paid pursuant to Section 2.1(f)(v), and (ii) cash in an amount equal to the MetroPCS Cash Amount (such deposited amount described in clauses (i) and (ii), the “MetroPCS Cash Deposit”); provided, that, if the Closing does not occur, the Payment Agent shall return, or cause to be returned, the MetroPCS Cash Deposit, and any interest or other income thereon, to MetroPCS on the next Business Day following the termination of this Agreement pursuant to its terms. Except as otherwise agreed to by the parties, the investment of the MetroPCS Cash Deposit shall in all events be limited to direct short-term obligations of, or short-term obligations fully guaranteed as to principal and interest by, the United States government, in commercial paper rated A-1 or P-1 or better by Xxxxx'x Investors Service, Inc. or Standard & Poor's Corporation, respectively, or in certificates of deposit, bank repurchase agreements, other bank instruments or direct deposits or banker's acceptances of commercial banks with capital exceeding $10,000,000,000 (based on the most recent financial statements of such bank that are then publicly available); provided, that no investment or loss thereon shall affect the amounts payable to holders of MetroPCS Common Stock pursuant to this Section 2.1. The MetroPCS Cash Deposit shall be used solely for purposes of making the Cash Payment and paying any cash in lieu of fractional shares to be paid pursuant to Section 2.1(f)(v), and shall not be used to satisfy any other obligation of MetroPCS, DT, TMUS or any of their respective Subsidiaries.

(f) Exchange of Shares.

(i) Notwithstanding anything in this Section 2.1(f) to the contrary, each certificate that immediately prior to the Effective Time represented shares of MetroPCS Common Stock (each, a “MetroPCS Certificate”) shall thereafter (and without the necessity of presenting the same for exchange) represent that number of shares of MetroPCS Common Stock into which the shares of MetroPCS Common Stock represented by such MetroPCS Certificate shall have been combined pursuant to the MetroPCS Reverse Stock Split, subject to the limitation on fractional shares pursuant to Section 2.1(f)(v).

(ii) As soon as practicable after the Closing, MetroPCS shall instruct the Payment Agent to send to each holder of record of a MetroPCS Certificate immediately prior to the Effective Time, (A) a letter of transmittal (which shall be in customary form and

23

shall specify, among other things, that the delivery shall be effected, and risk of loss and title to such MetroPCS Certificate shall pass, only upon proper delivery of such MetroPCS Certificate to the Payment Agent) and (B) instructions for use in effecting the surrender of such MetroPCS Certificate in exchange for a new certificate representing that number of shares of MetroPCS Common Stock into which the shares of MetroPCS Common Stock represented by such MetroPCS Certificate shall have been combined pursuant to the MetroPCS Reverse Stock Split, the portion of the MetroPCS Cash Amount that such holder has the right to receive pursuant to the Cash Payment and cash in lieu of fractional shares pursuant to Section 2.1(f)(v).

(iii) Upon surrender of a MetroPCS Certificate for cancellation to the Payment Agent, together with a properly completed letter of transmittal, the Payment Agent (A) shall register in the name of the holder of such MetroPCS Certificate the number of whole shares of MetroPCS Common Stock (in the form of book-entry shares, unless the holder of such MetroPCS Certificate expressly requests in writing that such shares be delivered in certificated form) representing, in the aggregate, the whole number of shares of MetroPCS Common Stock, if any, into which the shares of MetroPCS Common Stock represented by such MetroPCS Certificate shall have been combined pursuant to the MetroPCS Reverse Stock Split and (B) shall deliver to the holder of such MetroPCS Certificate a check or wire transfer in same day funds for the amount equal to the portion of the MetroPCS Cash Amount that such holder has the right to receive pursuant to the Cash Payment and cash payable in lieu of fractional shares pursuant to Section 2.1(f)(v). The MetroPCS Certificate so surrendered shall forthwith be cancelled. Promptly (and in any event no more than two Business Days) after the Closing, with respect to each holder of book-entry shares which immediately prior to the Effective Time represented shares of MetroPCS Common Stock (“MetroPCS Book-Entry Shares”), the Payment Agent (x) shall register in the name of such holder the number of whole shares of MetroPCS Common Stock (in the form of book-entry shares) representing, in the aggregate, the whole number of shares of MetroPCS Common Stock, if any, into which such holder's MetroPCS Book-Entry Shares shall have been combined pursuant to the MetroPCS Reverse Stock Split, and (y) deliver to such holder a check or wire transfer in same day funds for the amount equal to the portion of the MetroPCS Cash Amount that such holder has the right to receive pursuant to the Cash Payment and cash payable in lieu of fractional shares pursuant to Section 2.1(f)(v), without such holder being required to deliver a MetroPCS Certificate or an executed letter of transmittal to the Payment Agent. No interest will be paid or accrued on any MetroPCS Payment, any cash in lieu of fractional shares or any other cash payments payable in respect of any such securities pursuant to this Agreement.

(iv) If any shares of MetroPCS Common Stock that are combined pursuant to the MetroPCS Reverse Stock Split are to be registered in the name of, or if any cash in respect thereof is to be paid to, a Person other than that in whose name the MetroPCS Certificate(s) surrendered pursuant to this Section 2.1(f) is or are registered (whether as the result of a transfer of such shares or otherwise), it shall be a condition to the registration of such shares and the cash payments that (A) such certificate or certificates so surrendered shall be properly endorsed (or accompanied by an appropriate instrument or instruments of transfer as MetroPCS or the Payment Agent may reasonably request) and

24

otherwise in proper form for transfer, (B) the Person requesting such registration and payment shall pay to the Payment Agent in advance any transfer or other Taxes required by reason of the payment or registration in any name other than that of the registered holder of the shares represented by the MetroPCS Certificate surrendered or required for any other reason, or shall establish to the satisfaction of the Payment Agent that such Tax has been paid or is not payable, and (C) the Person receiving such payment and in whose name such shares are being registered (I) represents and warrants to MetroPCS that such Person is entitled to such payment and shares being registered and (II) agrees to indemnify MetroPCS from and against any and all Damages resulting from, arising out of, or incurred in connection with any claim that any other Person is entitled to such payment and shares being registered.